Question: Question 6 (0.2 points) If two investments have the same initial cost and equal lives, a high discount rate tends to favor O A) the

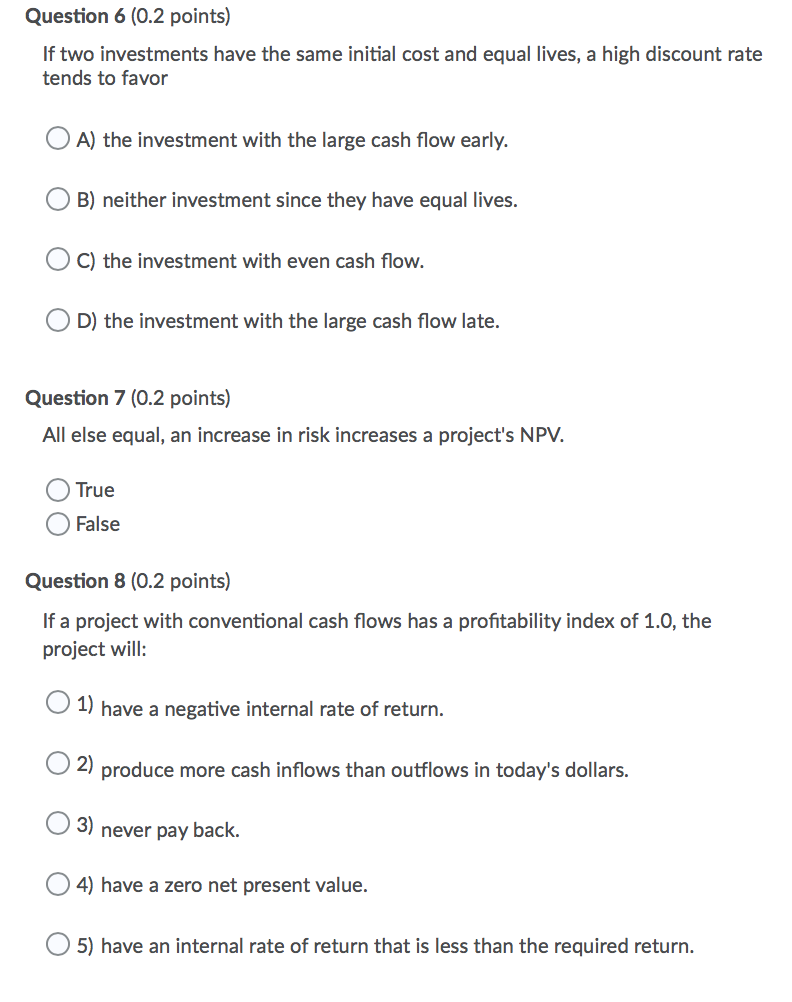

Question 6 (0.2 points) If two investments have the same initial cost and equal lives, a high discount rate tends to favor O A) the investment with the large cash flow early. OB) neither investment since they have equal lives. OC) the investment with even cash flow. OD) the investment with the large cash flow late. Question 7 (0.2 points) All else equal, an increase in risk increases a project's NPV. True False Question 8 (0.2 points) If a project with conventional cash flows has a profitability index of 1.0, the project will: 1) have a negative internal rate of return. O2) produce more cash inflows than outflows in today's dollars. O 3) never pay back. 04) have a zero net present value. 5) have an internal rate of return that is less than the required return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts