Question: Question 6 ( 1 0 marks; 3 6 minutes ) Copperstone Company has two divisions. The Bottle Division produces products that have variable costs of

Question marks; minutes

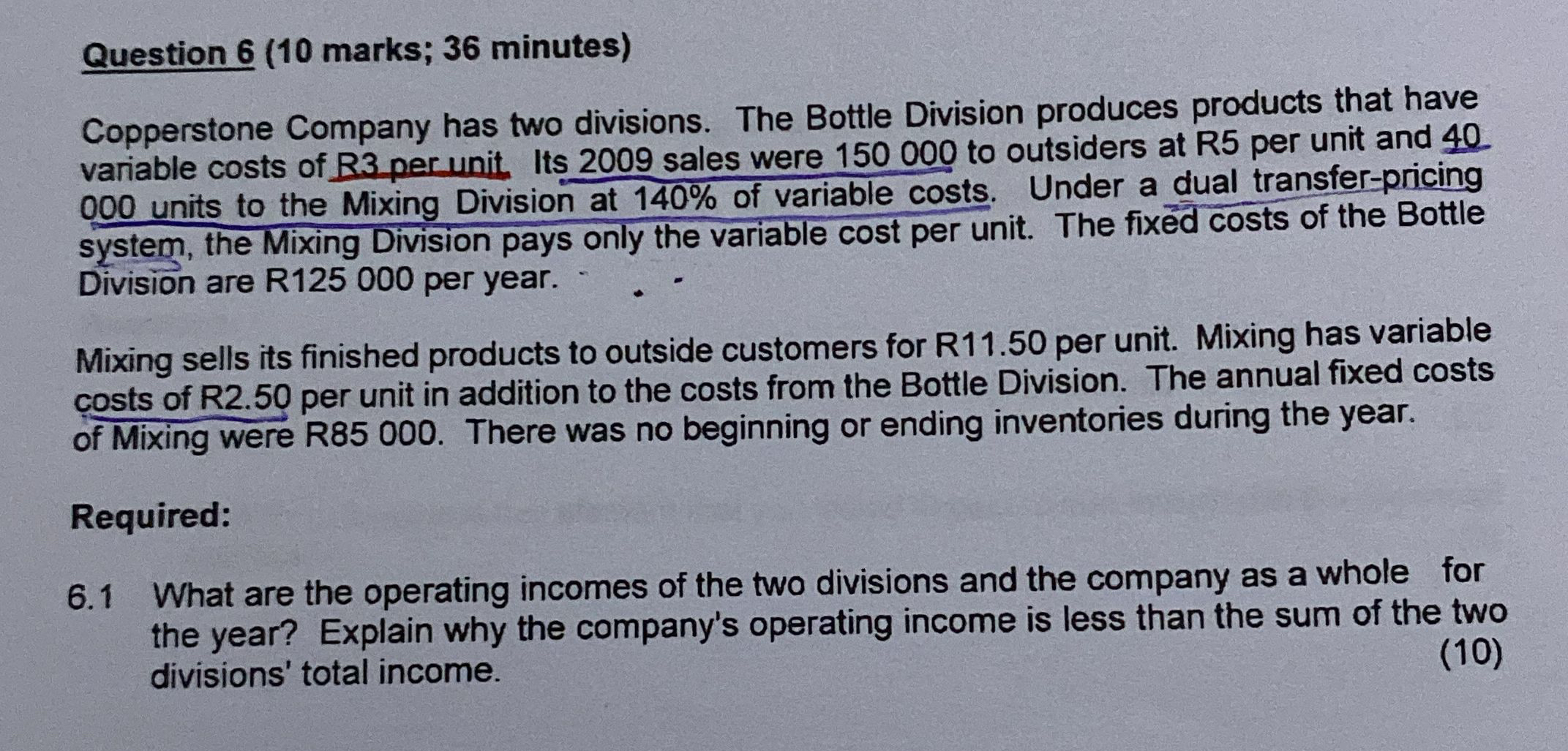

Copperstone Company has two divisions. The Bottle Division produces products that have

variable costs of R per unit. Its sales were to outsiders at R per unit and

units to the Mixing Division at of variable costs. Under a dual transferpricing

system, the Mixing Division pays only the variable cost per unit. The fixed costs of the Bottle

Division are R per year.

Mixing sells its finished products to outside customers for R per unit. Mixing has variable

costs of R per unit in addition to the costs from the Bottle Division. The annual fixed costs

of Mixing were R There was no beginning or ending inventories during the year.

Required:

What are the operating incomes of the two divisions and the company as a whole for

the year? Explain why the company's operating income is less than the sum of the two

divisions' total income.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock