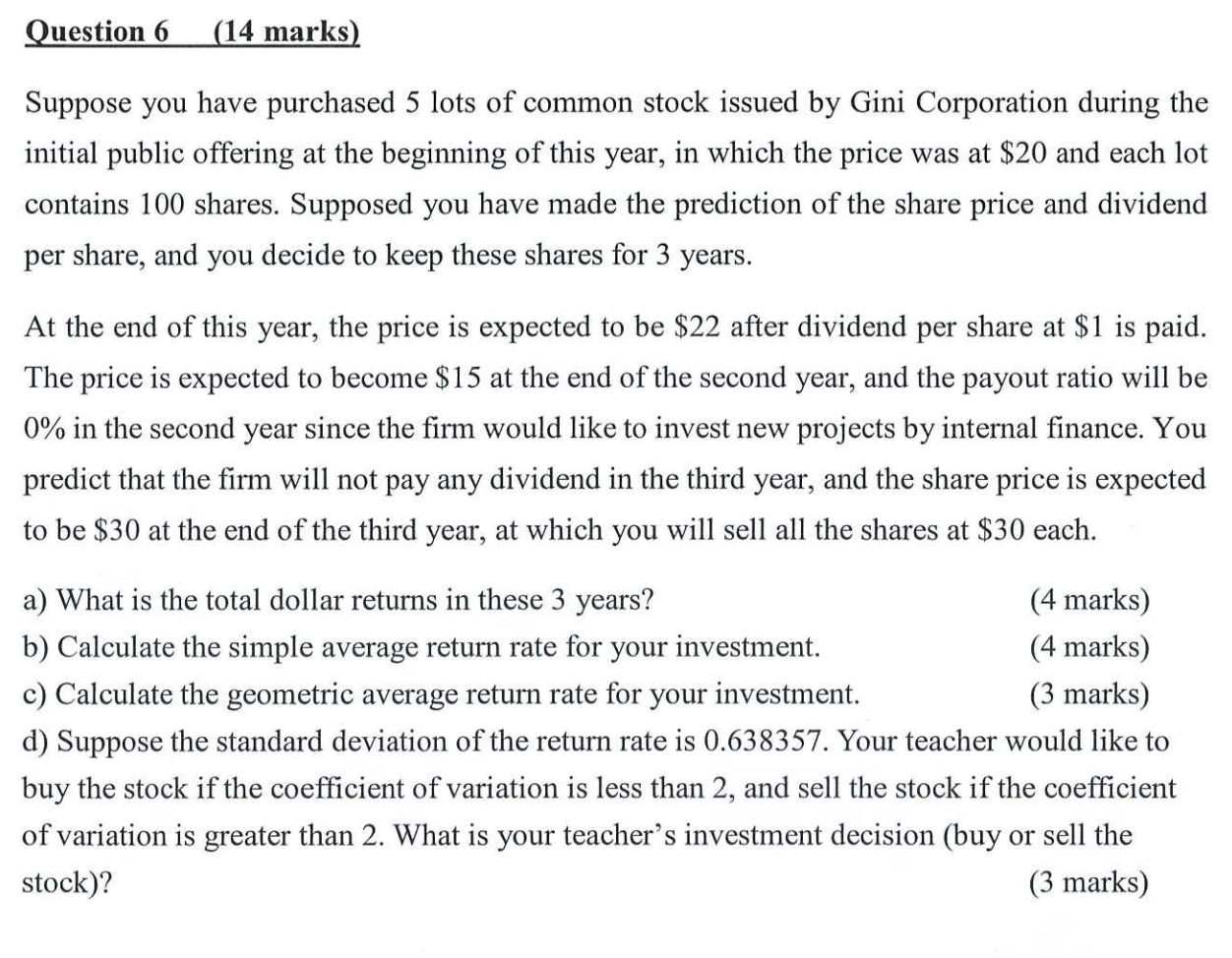

Question: Question 6 , ( 1 4 marks ) Suppose you have purchased 5 lots of common stock issued by Gini Corporation during the initial public

Question marks

Suppose you have purchased lots of common stock issued by Gini Corporation during the initial public offering at the beginning of this year, in which the price was at $ and each lot contains shares. Supposed you have made the prediction of the share price and dividend per share, and you decide to keep these shares for years.

At the end of this year, the price is expected to be $ after dividend per share at $ is paid.

The price is expected to become $ at the end of the second year, and the payout ratio will be in the second year since the firm would like to invest new projects by internal finance. You predict that the firm will not pay any dividend in the third year, and the share price is expected to be $ at the end of the third year, at which you will sell all the shares at $ each.

a What is the total dollar returns in these years?

marks

b Calculate the simple average return rate for your investment.

marks

c Calculate the geometric average return rate for your investment.

marks

d Suppose the standard deviation of the return rate is Your teacher would like to buy the stock if the coefficient of variation is less than and sell the stock if the coefficient of variation is greater than What is your teacher's investment decision buy or sell the stock

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock