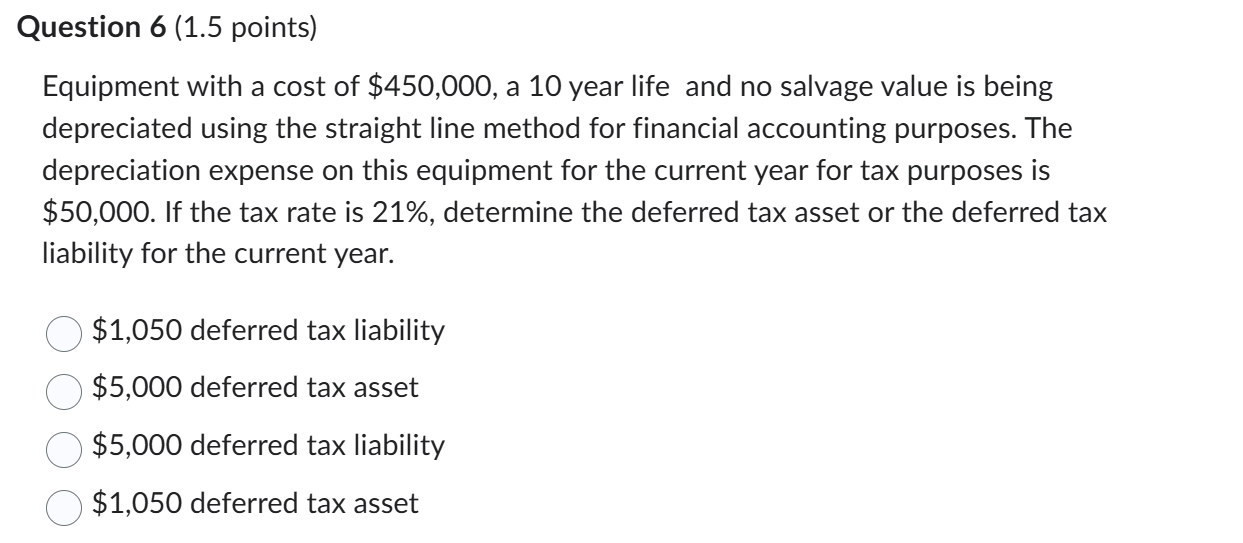

Question: Question 6 ( 1 . 5 points ) Equipment with a cost of ( $ 4 5 0 , 0 0 0

Question points

Equipment with a cost of $ a year life and no salvage value is being depreciated using the straight line method for financial accounting purposes. The depreciation expense on this equipment for the current year for tax purposes is $ If the tax rate is determine the deferred tax asset or the deferred tax liability for the current year.

$ deferred tax liability

$ deferred tax asset

$ deferred tax liability

$ deferred tax asset

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock