Question: Question 6 ( 1 . 5 points ) What is the bid price for the following situation: You have been approached by a client interested

Question points

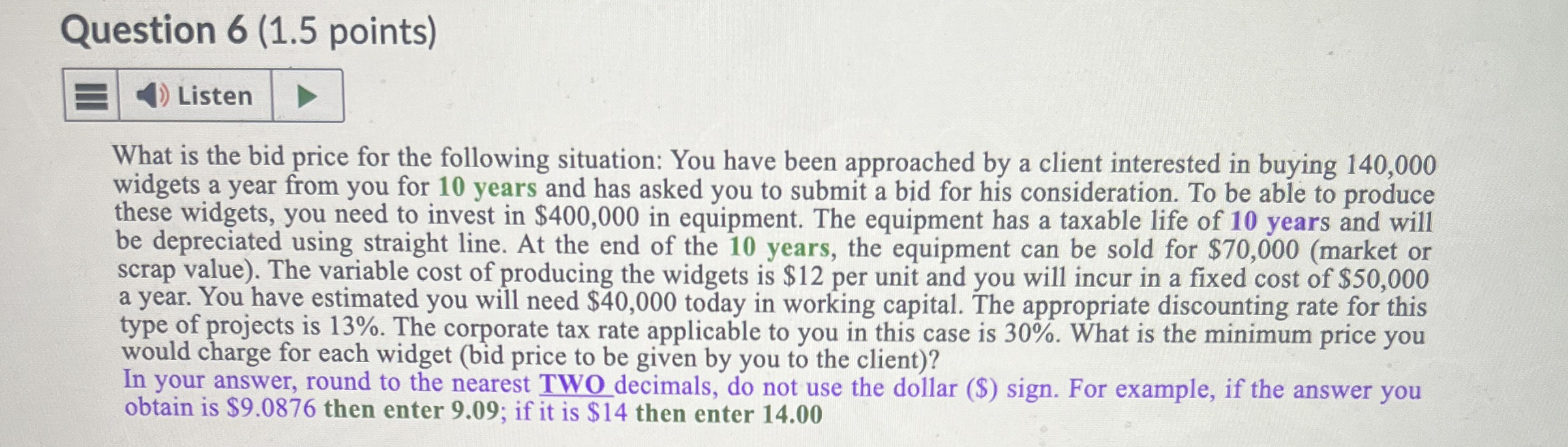

What is the bid price for the following situation: You have been approached by a client interested in buying widgets a year from you for years and has asked you to submit a bid for his consideration. To be able to produce these widgets, you need to invest in $ in equipment. The equipment has a taxable life of years and will be depreciated using straight line. At the end of the years, the equipment can be sold for $market or scrap value The variable cost of producing the widgets is $ per unit and you will incur in a fixed cost of $ a year. You have estimated you will need $ today in working capital. The appropriate discounting rate for this type of projects is The corporate tax rate applicable to you in this case is What is the minimum price you would charge for each widget bid price to be given by you to the client

In your answer, round to the nearest TWO decimals, do not use the dollar $ sign. For example, if the answer you obtain is $ then enter ; if it is $ then enter

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock