Question: Question 6 ( 1 point ) A company is considering the development of a new product. The first step would be to do a feasibility

Question point

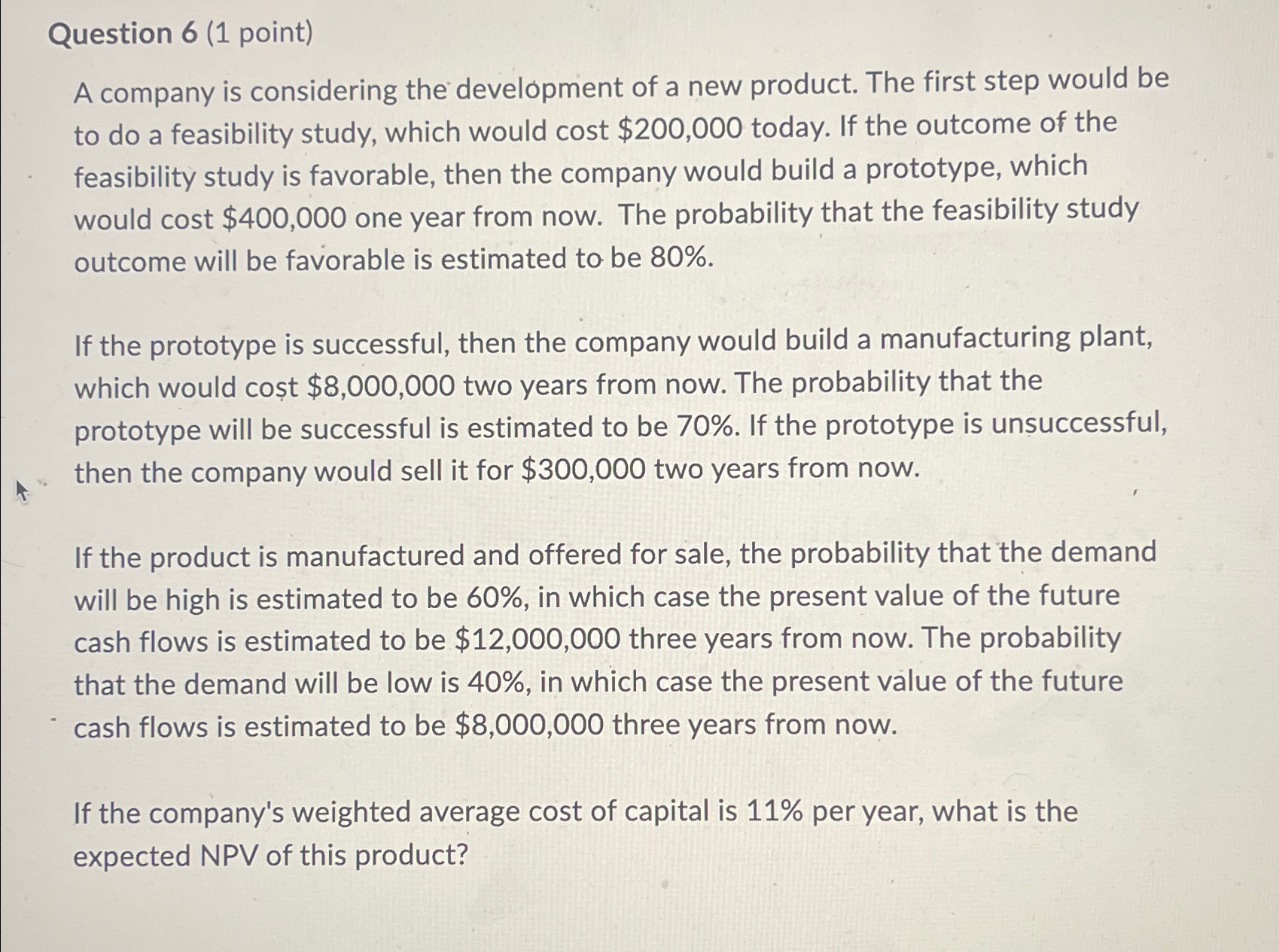

A company is considering the development of a new product. The first step would be to do a feasibility study, which would cost $ today. If the outcome of the feasibility study is favorable, then the company would build a prototype, which would cost $ one year from now. The probability that the feasibility study outcome will be favorable is estimated to be

If the prototype is successful, then the company would build a manufacturing plant, which would cost $ two years from now. The probability that the prototype will be successful is estimated to be If the prototype is unsuccessful, then the company would sell it for $ two years from now.

If the product is manufactured and offered for sale, the probability that the demand will be high is estimated to be in which case the present value of the future cash flows is estimated to be $ three years from now. The probability that the demand will be low is in which case the present value of the future cash flows is estimated to be $ three years from now.

If the company's weighted average cost of capital is per year, what is the expected NPV of this product?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock