Question: Question 6 (1 point) = HR Corporation has a beta of 2.0, while LR Corporation's beta is 0.5. The risk-free rate is 10 percent, and

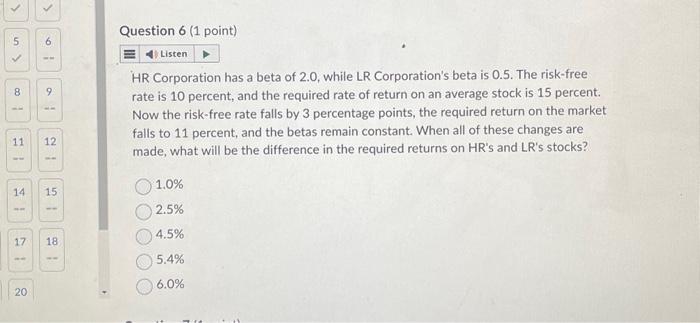

Question 6 (1 point) = HR Corporation has a beta of 2.0, while LR Corporation's beta is 0.5. The risk-free rate is 10 percent, and the required rate of return on an average stock is 15 percent. Now the risk-free rate falls by 3 percentage points, the required return on the market falls to 11 percent, and the betas remain constant. When all of these changes are made, what will be the difference in the required returns on HR's and LR's stocks? Listen 1.0% 2.5% 4.5% 5.4% 6.0%

HR Corporation has a beta of 2.0, while LR Corporation's beta is 0.5 . The risk-free rate is 10 percent, and the required rate of return on an average stock is 15 percent. Now the risk-free rate falls by 3 percentage points, the required return on the market falls to 11 percent, and the betas remain constant. When all of these changes are made, what will be the difference in the required returns on HR's and LR's stocks? 1.0% 2.5% 4.5% 5.4% 6.0%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock