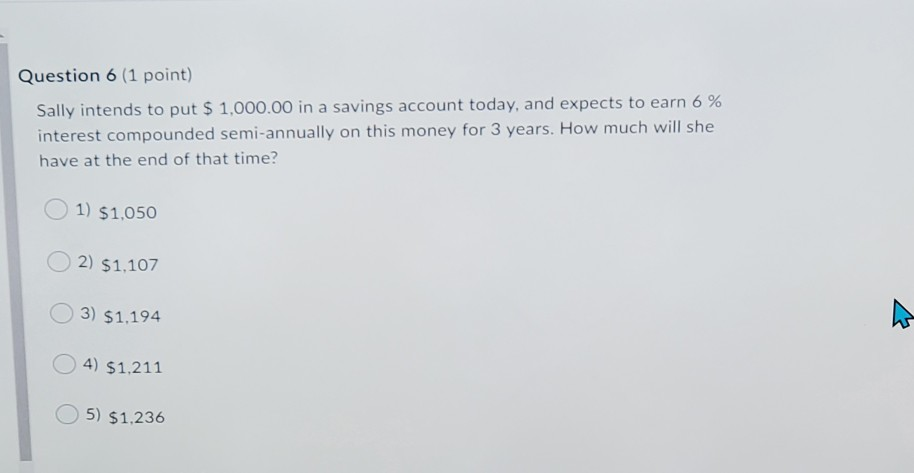

Question: Question 6 (1 point) Sally intends to put $ 1,000.00 in a savings account today, and expects to earn 6 % interest compounded semi-annually on

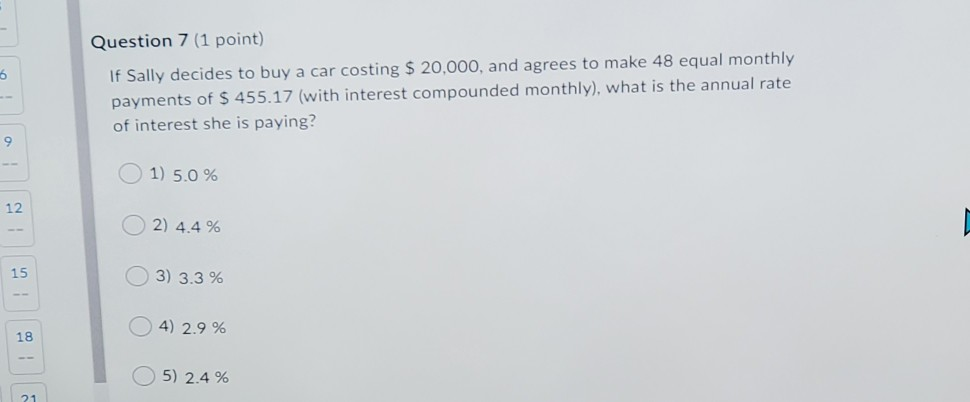

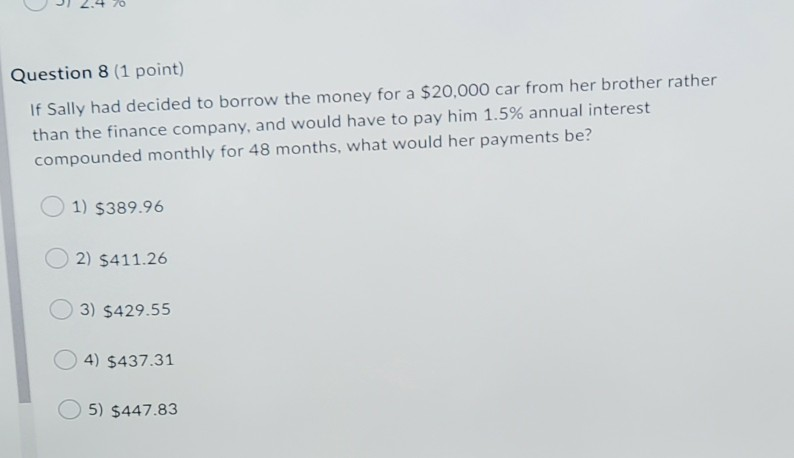

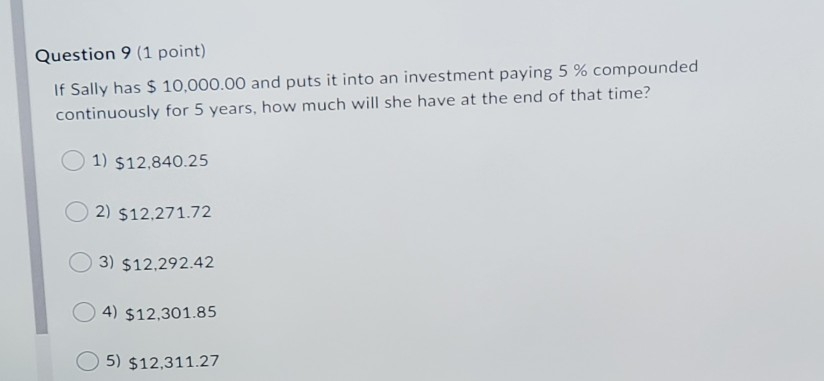

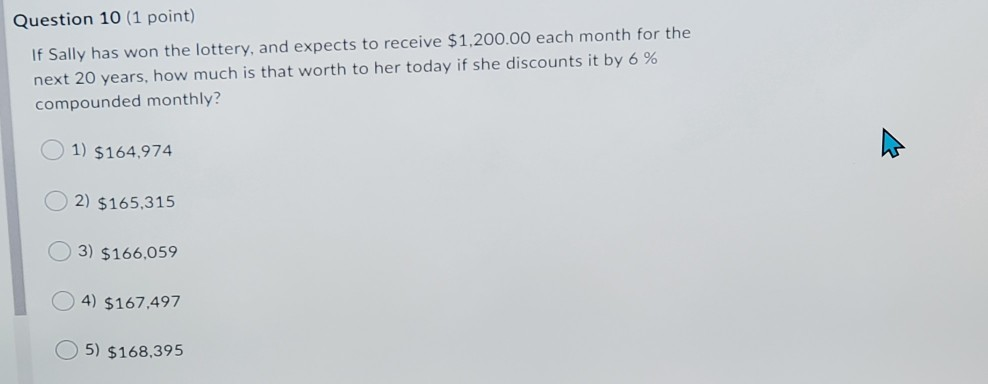

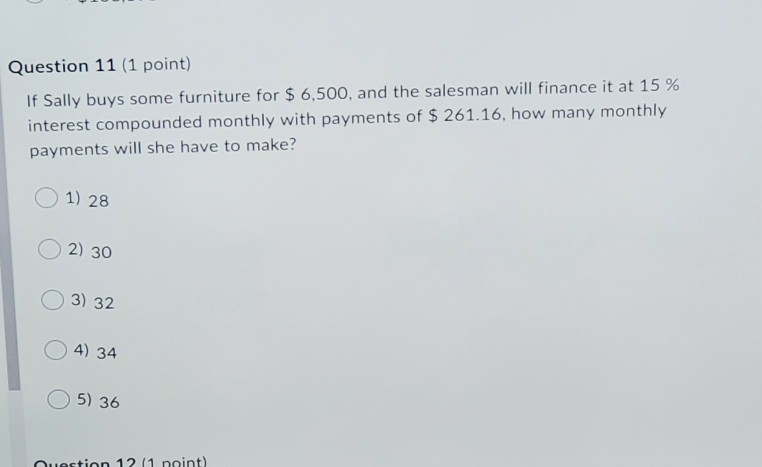

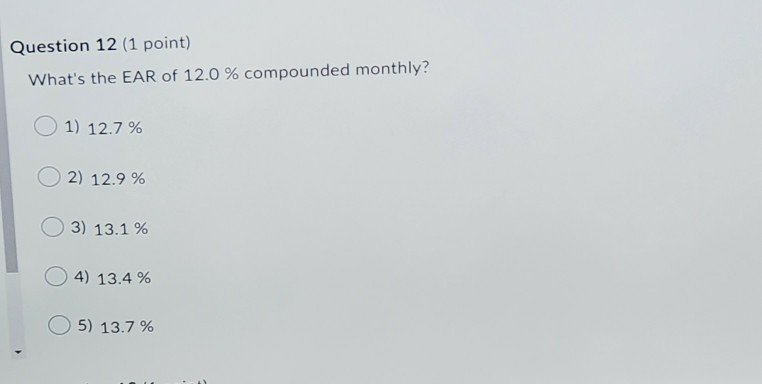

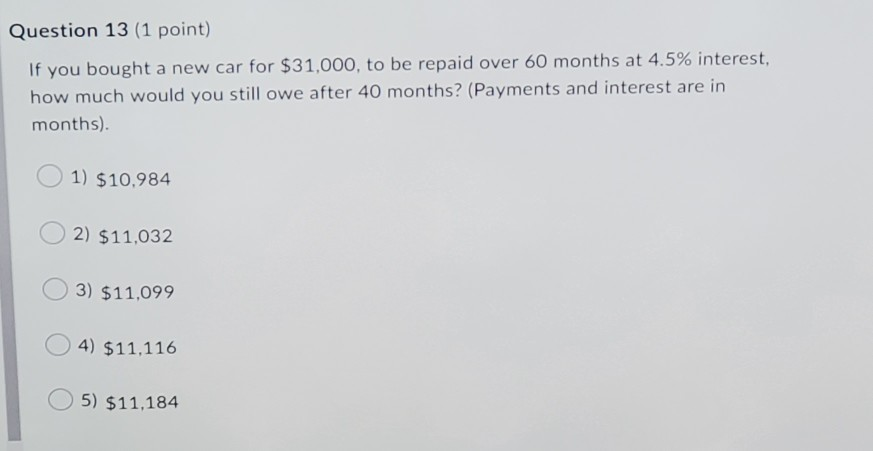

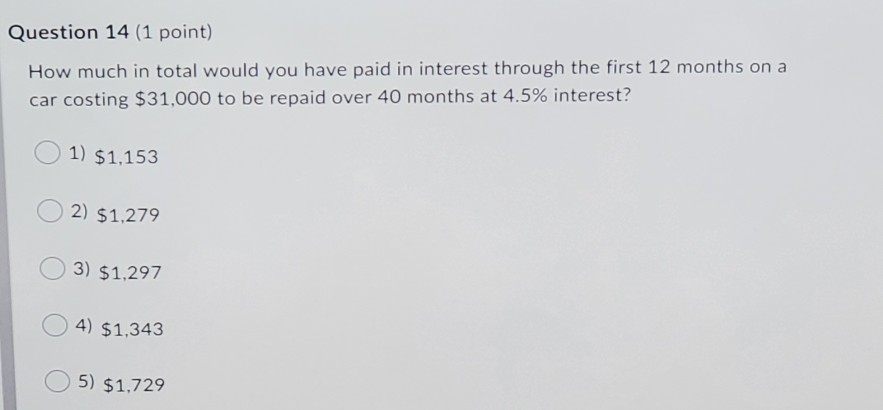

Question 6 (1 point) Sally intends to put $ 1,000.00 in a savings account today, and expects to earn 6 % interest compounded semi-annually on this money for 3 years. How much will she have at the end of that time? 1) $1,050 2) $1,107 3) $1,194 4) $1,211 5) $1,236 o Question 7 (1 point) If Sally decides to buy a car costing $ 20,000, and agrees to make 48 equal monthly payments of $ 455.17 (with interest compounded monthly), what is the annual rate of interest she is paying? 9 1) 5.0 % 12 2) 4.4 % 15 3) 3.3 % o 4) 2.9 % 18 5) 2.4% Question 8 (1 point) If Sally had decided to borrow the money for a $20,000 car from her brother rather than the finance company, and would have to pay him 1.5% annual interest compounded monthly for 48 months, what would her payments be? 1) $389.96 2) $411.26 3) $429.55 4) $437.31 5) $447.83 Question 9 (1 point) If Sally has $ 10,000.00 and puts it into an investment paying 5 % compounded continuously for 5 years, how much will she have at the end of that time? 1) $12,840.25 2) $12,271.72 3) $12,292.42 4) $12,301.85 5) $12,311.27 Question 10 (1 point) If Sally has won the lottery, and expects to receive $1,200.00 each month for the next 20 years, how much is that worth to her today if she discounts it by 6% compounded monthly? 1) $164.974 2) $165,315 3) $166,059 4) $167,497 5) $168,395 Question 11 (1 point) If Sally buys some furniture for $6,500, and the salesman will finance it at 15% interest compounded monthly with payments of $ 261.16, how many monthly payments will she have to make? 1) 28 2) 30 3) 32 4) 34 5) 36 Question 1211 noint) Question 12 (1 point) What's the EAR of 12.0 % compounded monthly? 1) 12.7% 2) 12.9% 3) 13.1 % 4) 13.4 % 5) 13.7 % Question 13 (1 point) If you bought a new car for $31,000, to be repaid over 60 months at 4.5% interest, how much would you still owe after 40 months? (Payments and interest are in months). 1) $10,984 2) $11,032 3) $11,099 4) $11.116 5) $11,184 Question 14 (1 point) How much in total would you have paid in interest through the first 12 months on a car costing $31,000 to be repaid over 40 months at 4.5% interest? 1) $1,153 2) $1,279 3) $1,297 4) $1,343 5) $1,729

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts