Question: Question 6 1 pts A stock has an expected return of 14 percent, its beta is 1.60, and the risk-free rate is 4.8 percent. What

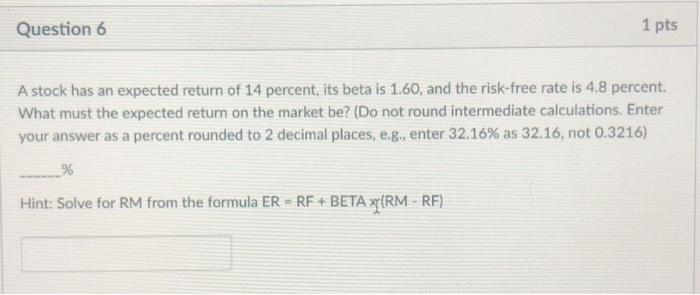

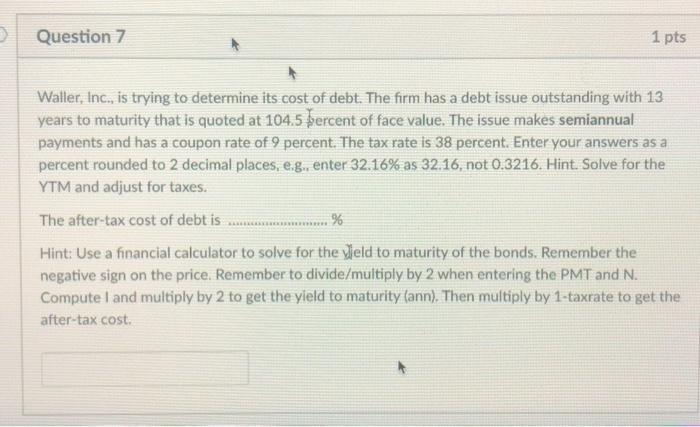

Question 6 1 pts A stock has an expected return of 14 percent, its beta is 1.60, and the risk-free rate is 4.8 percent. What must the expected return on the market be? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., enter 32.16% as 32.16, not 0.3216) % Hint: Solve for RM from the formula ER = RF + BETA xp (RM - RF) Question 7 1 pts Waller, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 13 years to maturity that is quoted at 104.5 percent of face value. The issue makes semiannual payments and has a coupon rate of 9 percent. The tax rate is 38 percent. Enter your answers as a percent rounded to 2 decimal places, e.g.. enter 32.16% as 32.16, not 0.3216. Hint. Solve for the YTM and adjust for taxes. The after-tax cost of debt is % Hint: Use a financial calculator to solve for the vield to maturity of the bonds. Remember the negative sign on the price. Remember to divide/multiply by 2 when entering the PMT and N. Computel and multiply by 2 to get the yield to maturity (ann). Then multiply by 1-taxrate to get the after-tax cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts