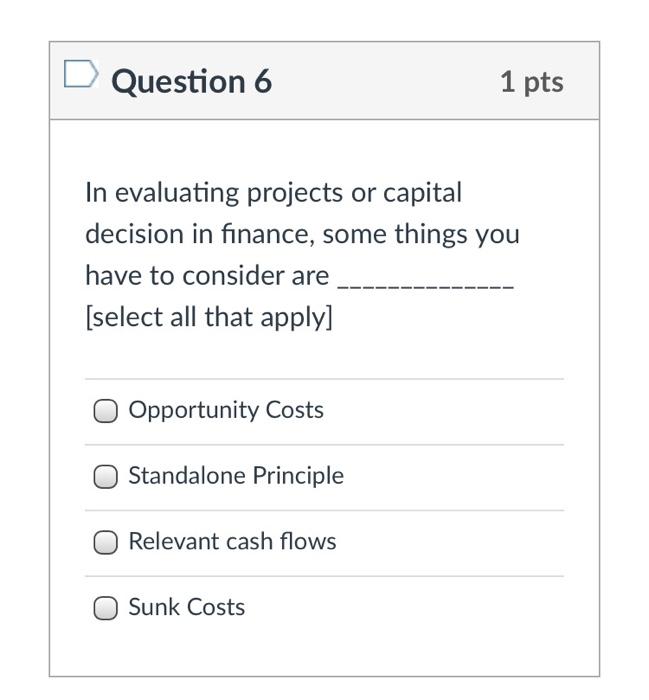

Question: Question 6 1 pts In evaluating projects or capital decision in finance, some things you have to consider are [select all that apply] Opportunity Costs

![finance, some things you have to consider are [select all that apply]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ed759fa7ee7_17566ed759f3ed6b.jpg)

Question 6 1 pts In evaluating projects or capital decision in finance, some things you have to consider are [select all that apply] Opportunity Costs Standalone Principle Relevant cash flows Sunk Costs Question 7 1 pts When making capital budgeting decisions based on Net Present Value (NPV). The decision making criteria can be accept if NPV greater than or equal to O Reject if internal rate > expected return Accept if NPV> else reject Reject if NPV>0 else accept

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts