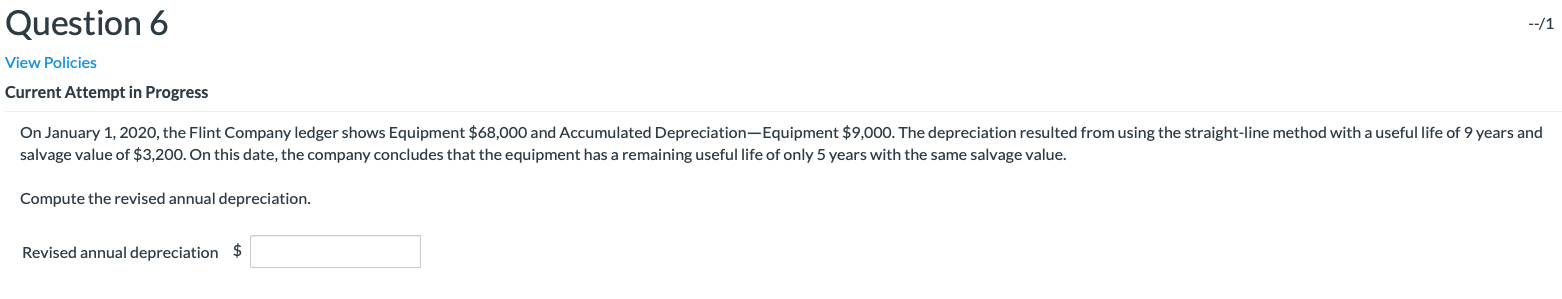

Question: Question 6 --/1 View Policies Current Attempt in Progress On January 1, 2020, the Flint Company ledger shows Equipment $68,000 and Accumulated Depreciation Equipment $9,000.

Question 6 --/1 View Policies Current Attempt in Progress On January 1, 2020, the Flint Company ledger shows Equipment $68,000 and Accumulated Depreciation Equipment $9,000. The depreciation resulted from using the straight-line method with a useful life of 9 years and salvage value of $3,200. On this date, the company concludes that the equipment has a remaining useful life of only 5 years with the same salvage value. Compute the revised annual depreciation. Revised annual depreciation $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts