Question: Question 6 (10 marks) Castle Ltd is attempting to evaluate the feasibility of investing $450,000 in a new printing machine with a five-year life. The

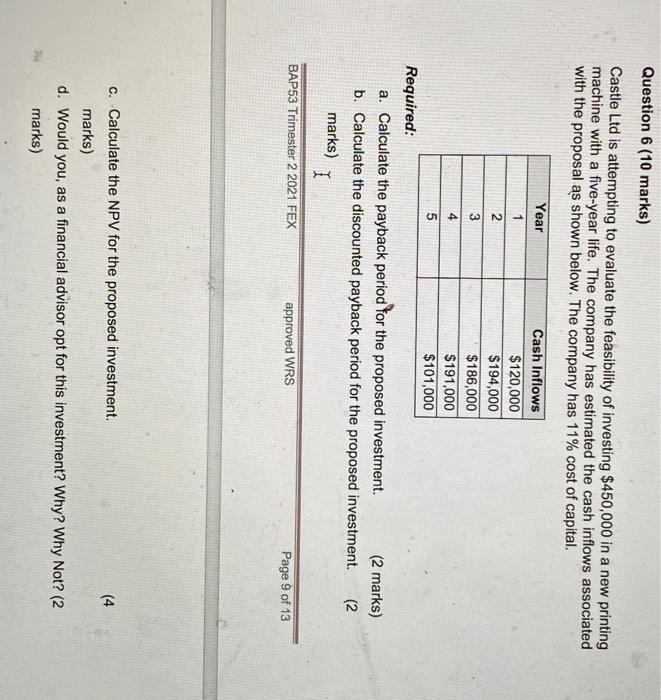

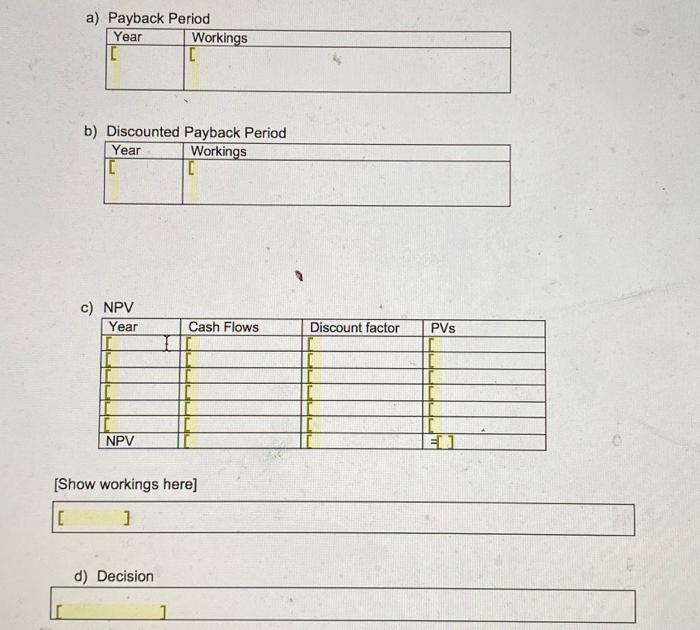

Question 6 (10 marks) Castle Ltd is attempting to evaluate the feasibility of investing $450,000 in a new printing machine with a five-year life. The company has estimated the cash inflows associated with the proposal as shown below. The company has 11% cost of capital. 4 Year Cash Inflows 1 $120,000 2 $194,000 3 $186,000 4 $191,000 5 $101,000 Required: a. Calculate the payback period for the proposed investment. (2 marks) b. Calculate the discounted payback period for the proposed investment. (2 marks) I BAP53 Trimester 2 2021 FEX approved WRS Page 9 of 13 c. Calculate the NPV for the proposed investment. (4 marks) d. Would you, as a financial advisor opt for this investment? Why? Why Not? (2 marks) a) Payback Period Year Workings IC [ b) Discounted Payback Period Year Workings C c) NPV Year Cash Flows Discount factor PVs NPV EN [Show workings here) [ 1 d) Decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts