Question: Question 6 (10 marks) Density 46's income statement for the year ended October 31, 2021, had the following condensed information: Service revenue $778,000 Operating expenses

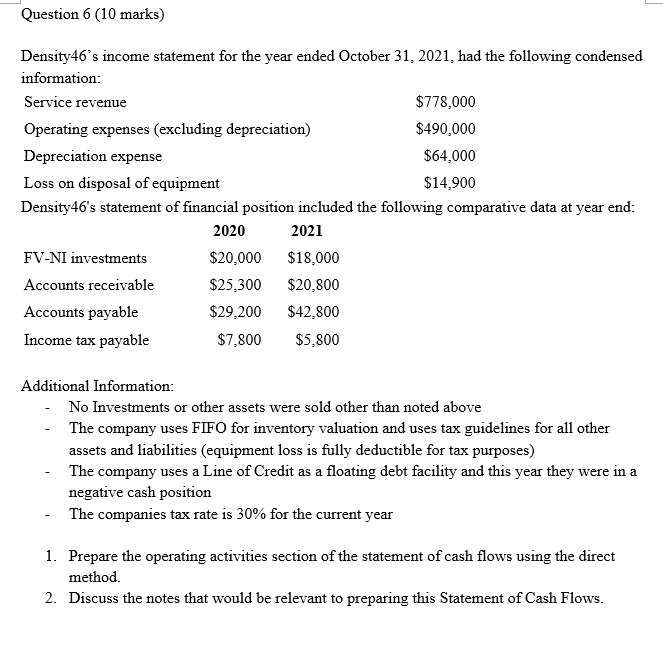

Question 6 (10 marks) Density 46's income statement for the year ended October 31, 2021, had the following condensed information: Service revenue $778,000 Operating expenses (excluding depreciation) $490,000 Depreciation expense $64,000 Loss on disposal of equipment $14,900 Density46's statement of financial position included the following comparative data at year end: 2020 2021 FV-NI investments $20,000 $18,000 Accounts receivable $25,300 $20,800 Accounts payable $29,200 $42,800 Income tax payable $7,800 $5,800 Additional Information: No Investments or other assets were sold other than noted above The company uses FIFO for inventory valuation and uses tax guidelines for all other assets and liabilities (equipment loss is fully deductible for tax purposes) The company uses a Line of Credit as a floating debt facility and this year they were in a negative cash position The companies tax rate is 30% for the current year 1. Prepare the operating activities section of the statement of cash flows using the direct method. 2. Discuss the notes that would be relevant to preparing this Statement of Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts