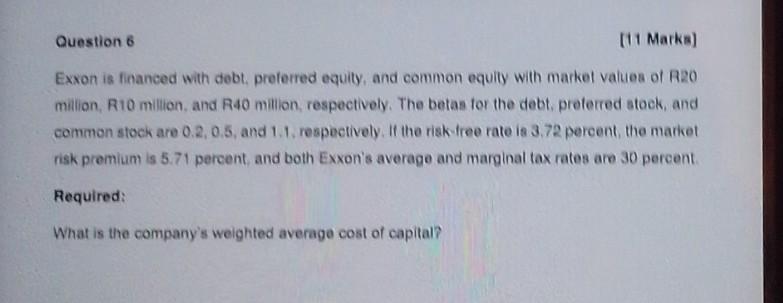

Question: Question 6 (11 Marka) Exxon is financed with debt, preferred equity, and common equity with market values of RRO million, R10 million and R40 million,

Question 6 (11 Marka) Exxon is financed with debt, preferred equity, and common equity with market values of RRO million, R10 million and R40 million, respectively. The betas for the debt preferred stock, and common stock are 0.2, 0.5, and 1.1. respectively. If the risk free rate is 3.72 percent the market risk premium is 5.71 percent and both Exxon's average and marginal tax rates are 30 percent Required: What is the company's weighted average cost of capital

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock