Question: > > Question 6 (12 marks) a) About a specific European call option on a non-dividend paying stock, we know the following: current stock price

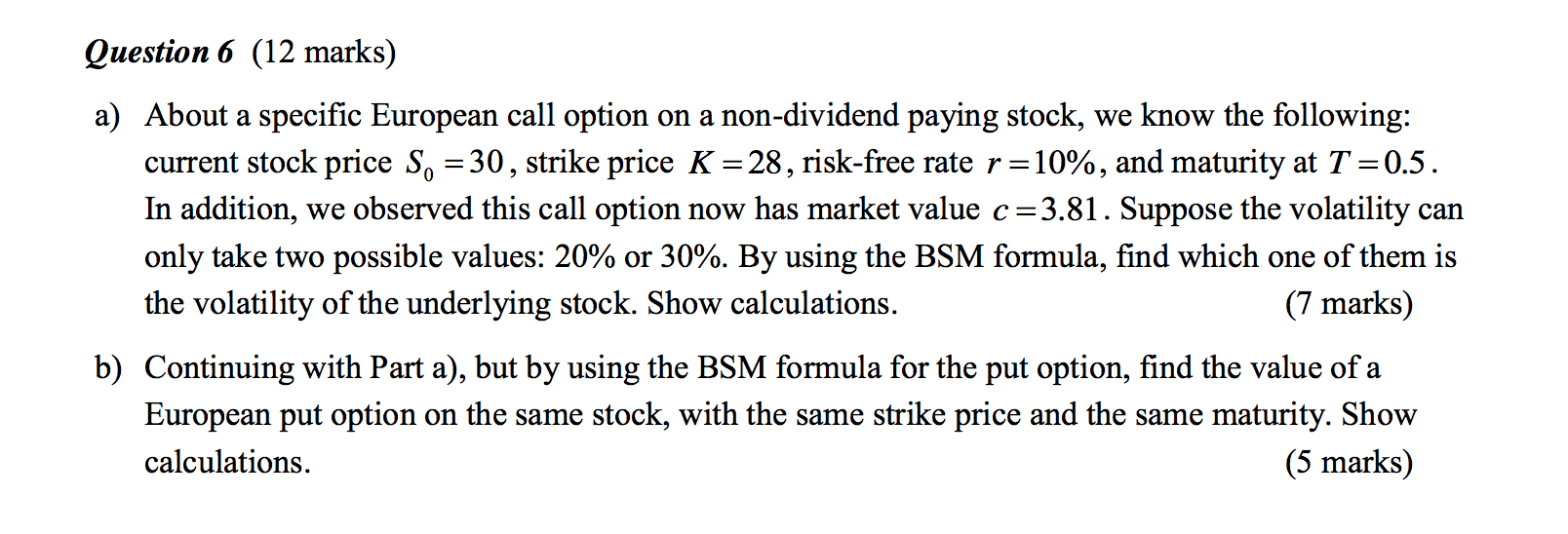

> > Question 6 (12 marks) a) About a specific European call option on a non-dividend paying stock, we know the following: current stock price S. = 30, strike price K = 28, risk-free rate r=10%, and maturity at T=0.5. In addition, we observed this call option now has market value c =3.81. Suppose the volatility can only take two possible values: 20% or 30%. By using the BSM formula, find which one of them is the volatility of the underlying stock. Show calculations. (7 marks) b) Continuing with Part a), but by using the BSM formula for the put option, find the value of a European put option on the same stock, with the same strike price and the same maturity. Show calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts