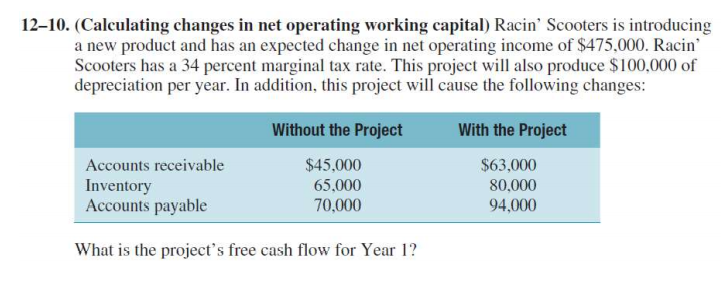

Question: QUESTION 6 1210. {Calculating changes in net operating working capital) Racin' Scooters is introducing a new product and has an expected change in net operating

QUESTION 6

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock