Question: Question 6 (14 marks) You are told to value a private business with the following information: EBIT: $350,000, which is expected to grow at 2%

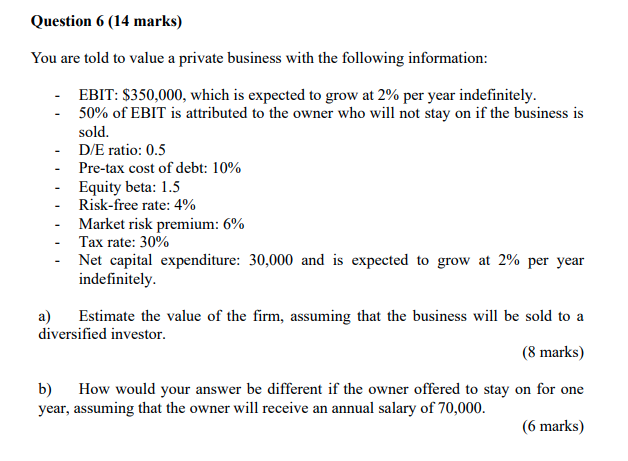

Question 6 (14 marks) You are told to value a private business with the following information: EBIT: $350,000, which is expected to grow at 2% per year indefinitely. 50% of EBIT is attributed to the owner who will not stay on if the business is sold. - D/E ratio: 0.5 - Pre-tax cost of debt: 10% Equity beta: 1.5 Risk-free rate: 4% - Market risk premium: 6% Tax rate: 30% Net capital expenditure: 30,000 and is expected to grow at 2% per year indefinitely. a) Estimate the value of the firm, assuming that the business will be sold to a diversified investor. (8 marks) b) How would your answer be different if the owner offered to stay on for one year, assuming that the owner will receive an annual salary of 70,000. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts