Question: Question 6 (16 points) A. Table 1 below presents market values and O&M costs for a factory equipment. (a) Compute the EUAC of the equipment

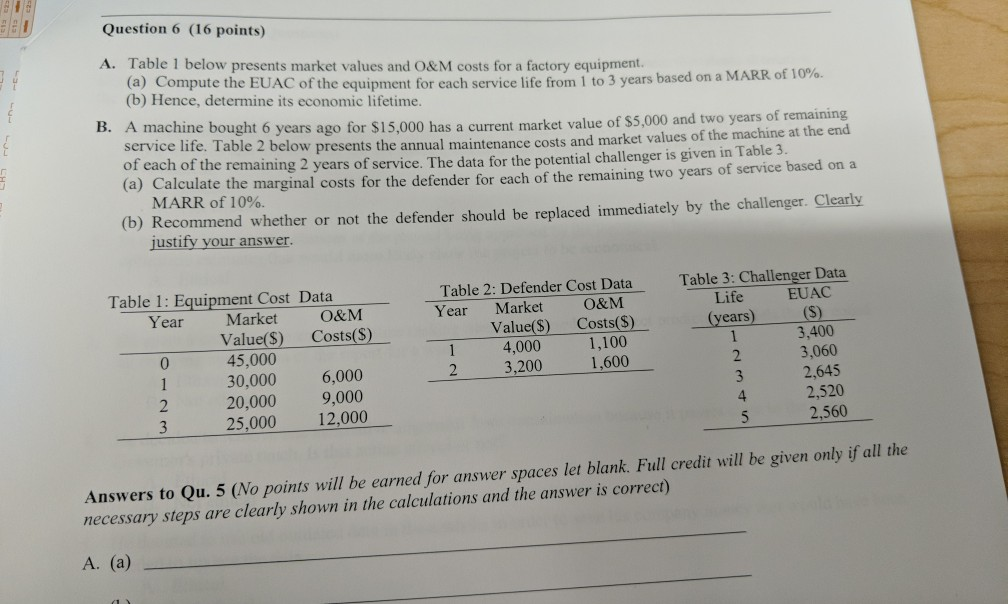

Question 6 (16 points) A. Table 1 below presents market values and O&M costs for a factory equipment. (a) Compute the EUAC of the equipment for each service life from I to 3 years based on a M (b) Hence, determine its economic lifetime A machine service life. Ta of each (a) Calculate the marginal B. bought 6 years ago for S15,000 has a current market value of $5,000 and two years of remaining ble 2 below presents the annual maintenance costs and market values of the machine at the end of the remaining 2 years of service. The data for the potential challenger is given in Table 3 costs for the defender for each of the remaining two years of service based on a MARR of 10%. (b) Recommend whether or not the defender should be replaced immediately by the challenger. Clearly justify your answer Table 1: Equipment Cost DataTable 2: Defender Cost Data Table 3: Challenger Data Life EUAC O&M Year Market Year Market O&M Value(S) Costs(S)Value(S) Costs(S) (years)(S) 45,000 30,000 6,000 3,400 3,060 2,645 2,520 2,560 1,100 1,600 4,000 3,200 0 2 20,000 9,000 4 5 25,000 12,00 Answers to Qu. 5 (No points will be earned for answer spaces let blank. Full credit will be given only if all necessary steps are clearly shown in the calculations and the answer is correct) A. (a) Question 6 (16 points) A. Table 1 below presents market values and O&M costs for a factory equipment. (a) Compute the EUAC of the equipment for each service life from I to 3 years based on a M (b) Hence, determine its economic lifetime A machine service life. Ta of each (a) Calculate the marginal B. bought 6 years ago for S15,000 has a current market value of $5,000 and two years of remaining ble 2 below presents the annual maintenance costs and market values of the machine at the end of the remaining 2 years of service. The data for the potential challenger is given in Table 3 costs for the defender for each of the remaining two years of service based on a MARR of 10%. (b) Recommend whether or not the defender should be replaced immediately by the challenger. Clearly justify your answer Table 1: Equipment Cost DataTable 2: Defender Cost Data Table 3: Challenger Data Life EUAC O&M Year Market Year Market O&M Value(S) Costs(S)Value(S) Costs(S) (years)(S) 45,000 30,000 6,000 3,400 3,060 2,645 2,520 2,560 1,100 1,600 4,000 3,200 0 2 20,000 9,000 4 5 25,000 12,00 Answers to Qu. 5 (No points will be earned for answer spaces let blank. Full credit will be given only if all necessary steps are clearly shown in the calculations and the answer is correct) A. (a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts