Question: Question 6 (2 points) Listen The net present value method is better than the internal rate of return because it always yields the same result

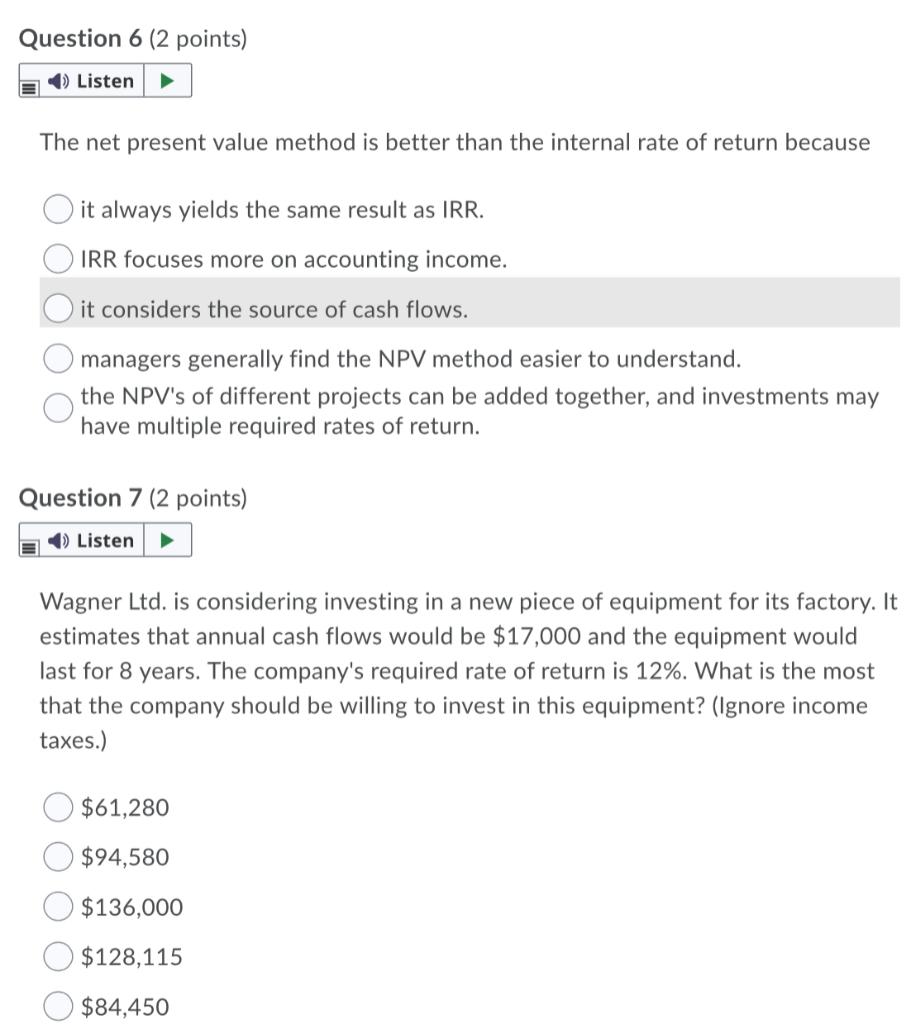

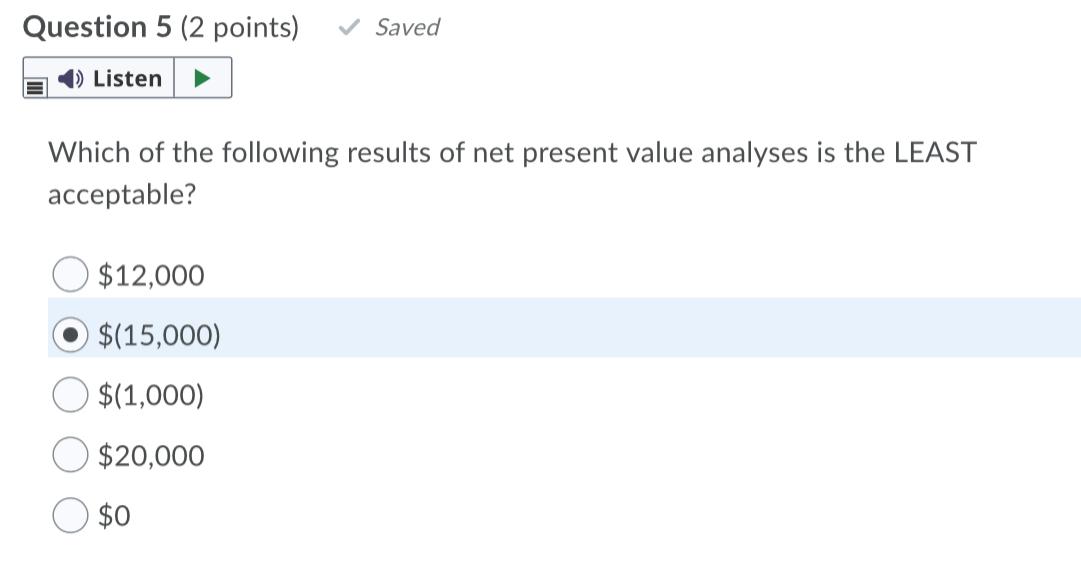

Question 6 (2 points) Listen The net present value method is better than the internal rate of return because it always yields the same result as IRR. IRR focuses more on accounting income. it considers the source of cash flows. managers generally find the NPV method easier to understand. the NPV's of different projects can be added together, and investments may have multiple required rates of return. Question 7 (2 points) Listen Wagner Ltd. is considering investing in a new piece of equipment for its factory. It estimates that annual cash flows would be $17,000 and the equipment would last for 8 years. The company's required rate of return is 12%. What is the most that the company should be willing to invest in this equipment? (Ignore income taxes.) $61,280 $94,580 $136,000 $128,115 $84,450 Question 5 (2 points) Saved ) Listen Which of the following results of net present value analyses is the LEAST acceptable? $12,000 $(15,000) $(1,000) $20,000 $0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts