Question: Question 6 (20 marks) a) A trader buys a (long) call option with a strike price of $40 and a (long) put option with a

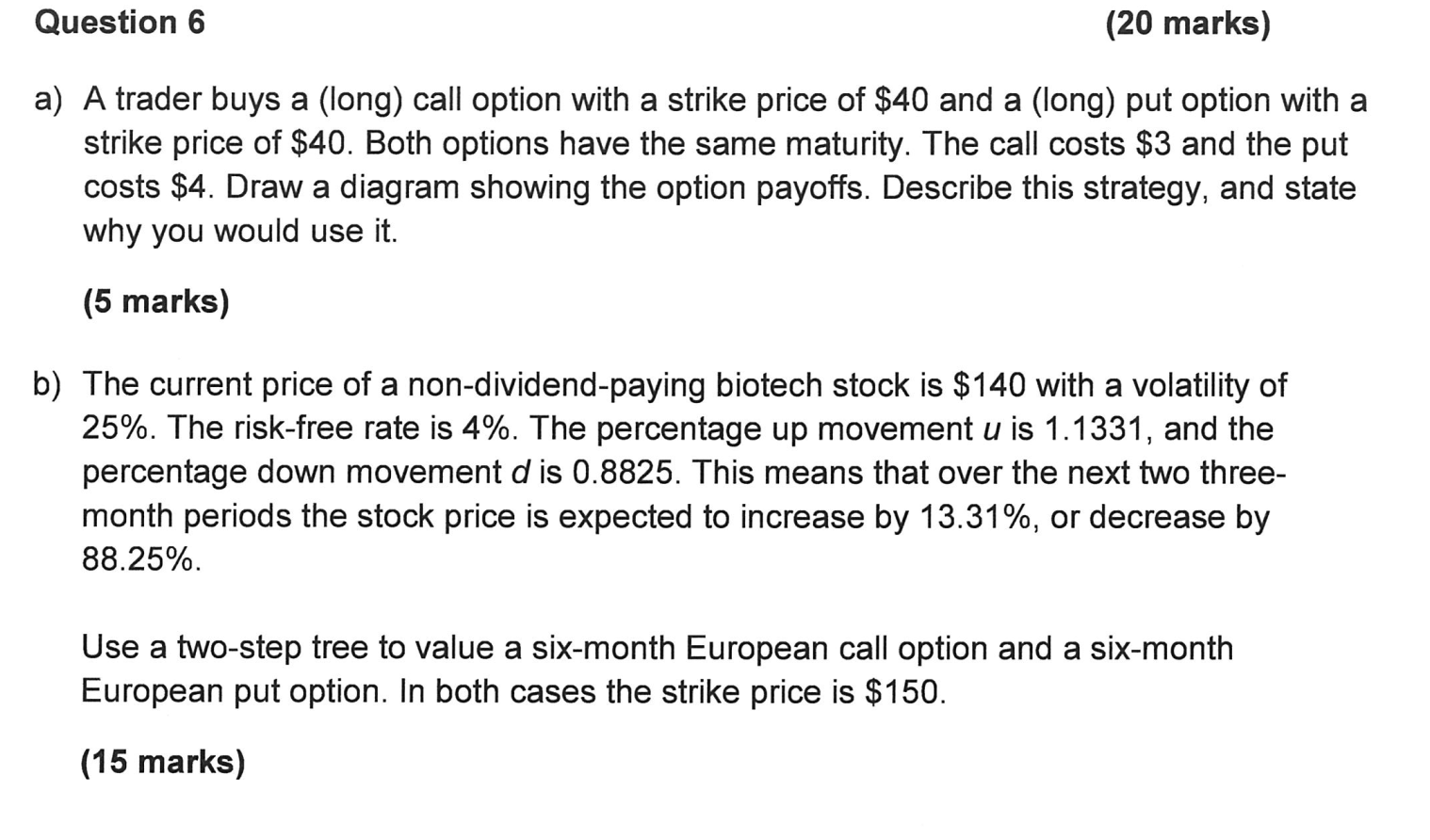

Question 6 (20 marks) a) A trader buys a (long) call option with a strike price of $40 and a (long) put option with a strike price of $40. Both options have the same maturity. The call costs $3 and the put costs $4. Draw a diagram showing the option payoffs. Describe this strategy, and state why you would use it. (5 marks) b) The current price of a non-dividend-paying biotech stock is $140 with a volatility of 25%. The risk-free rate is 4%. The percentage up movement u is 1.1331, and the percentage down movement d is 0.8825. This means that over the next two three- month periods the stock price is expected to increase by 13.31%, or decrease by 88.25%. Use a two-step tree to value a six-month European call option and a six-month European put option. In both cases the strike price is $150. (15 marks) Question 6 (20 marks) a) A trader buys a (long) call option with a strike price of $40 and a (long) put option with a strike price of $40. Both options have the same maturity. The call costs $3 and the put costs $4. Draw a diagram showing the option payoffs. Describe this strategy, and state why you would use it. (5 marks) b) The current price of a non-dividend-paying biotech stock is $140 with a volatility of 25%. The risk-free rate is 4%. The percentage up movement u is 1.1331, and the percentage down movement d is 0.8825. This means that over the next two three- month periods the stock price is expected to increase by 13.31%, or decrease by 88.25%. Use a two-step tree to value a six-month European call option and a six-month European put option. In both cases the strike price is $150. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts