Question: Question 6 4 points Save Answer Consider the performance over the last year of the following two well-diversified Australian large- capitalization stock managed funds. For

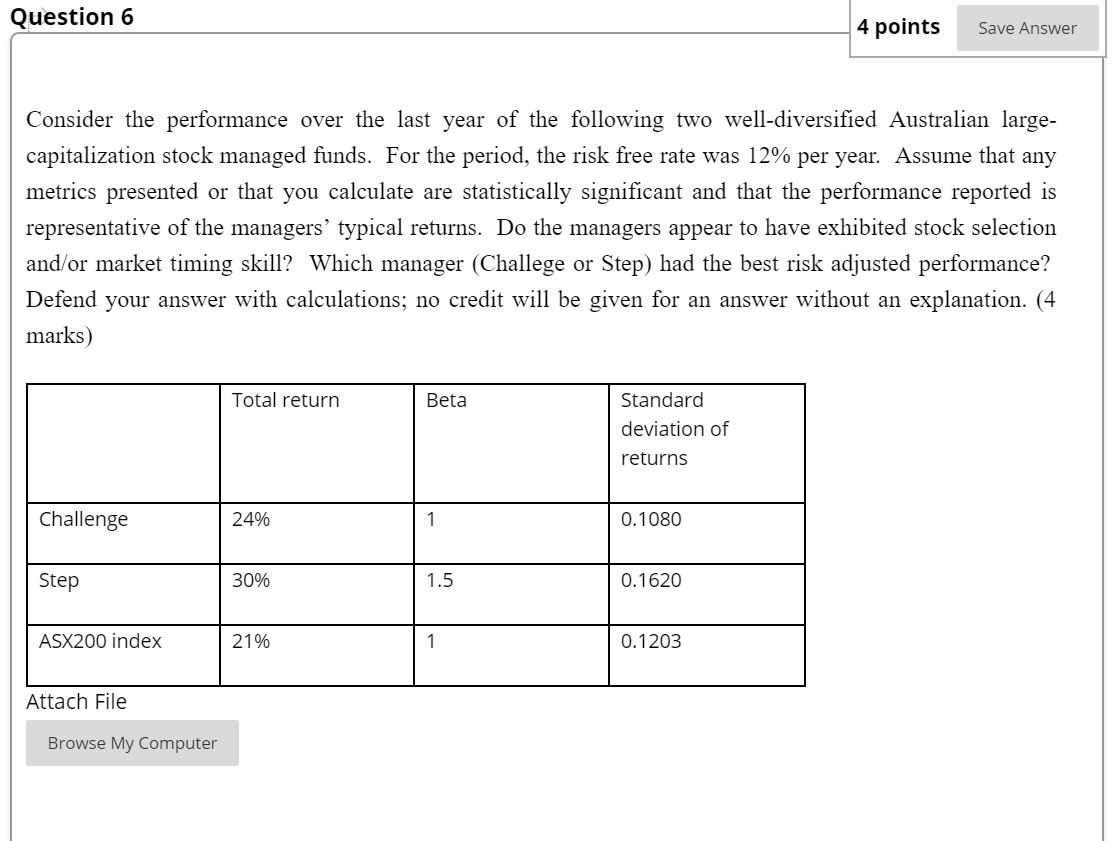

Question 6 4 points Save Answer Consider the performance over the last year of the following two well-diversified Australian large- capitalization stock managed funds. For the period, the risk free rate was 12% per year. Assume that any metrics presented or that you calculate are statistically significant and that the performance reported is representative of the managers' typical returns. Do the managers appear to have exhibited stock selection and/or market timing skill? Which manager (Challege or Step) had the best risk adjusted performance? Defend your answer with calculations; no credit will be given for an answer without an explanation. (4 marks) Total return Beta Standard deviation of returns Challenge 24% 1 0.1080 Step 30% 1.5 0.1620 ASX200 index 21% 1 0.1203 Attach File Browse My Computer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts