Question: Question 6 4 points Save McDonald's is a U.S. based company. Assume a British subsidiary of McDonald's enters into a USD 25 million 5-year cross

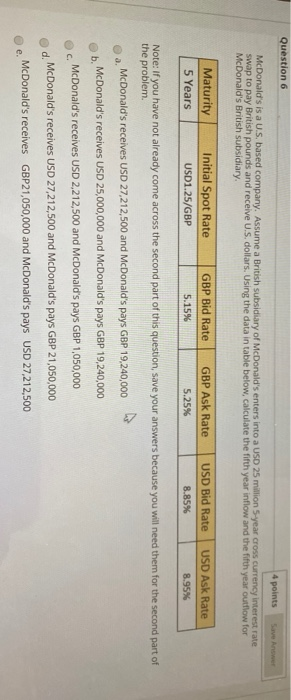

Question 6 4 points Save McDonald's is a U.S. based company. Assume a British subsidiary of McDonald's enters into a USD 25 million 5-year cross currency interest rate swap to pay British pounds and receive U.S. dollars. Using the data in table below, calculate the fifth year inflow and the fifth year outflow for McDonald's British subsidiary. Maturity 5 Years Initial Spot Rate USD1.25/GBP GBP Bid Rate 5.15% GBP Ask Rate 5.25% USD Bid Rate 8.85% USD Ask Rate 8.95% Note: If you have not already come across the second part of this question, save your answers because you will need them for the second part of the problem McDonald's receives USD 27,212,500 and McDonald's pays GBP 19,240,000 b. McDonald's receives USD 25,000,000 and McDonald's pays GBP 19,240,000 McDonald's receives USD 2,212,500 and McDonald's pays GBP 1,050,000 d McDonald's receives USD 27,212,500 and McDonald's pays GBP 21,050,000 McDonald's receives GBP21,050,000 and McDonald's pays USD 27,212,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts