Question: QUESTION 6 (5 marks) A machine was acquired on January 1, 2015, at a cost of $80,000. The machine was originally estimated to have a

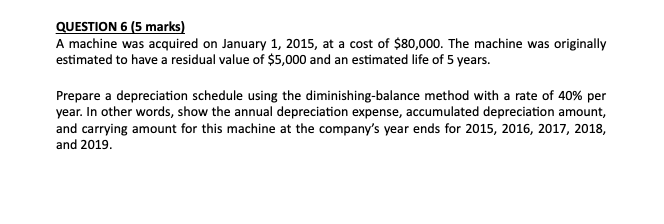

QUESTION 6 (5 marks) A machine was acquired on January 1, 2015, at a cost of $80,000. The machine was originally estimated to have a residual value of $5,000 and an estimated life of 5 years. Prepare a depreciation schedule using the diminishing-balance method with a rate of 40% per year. In other words, show the annual depreciation expense, accumulated depreciation amount, and carrying amount for this machine at the company's year ends for 2015, 2016, 2017, 2018, and 2019

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock