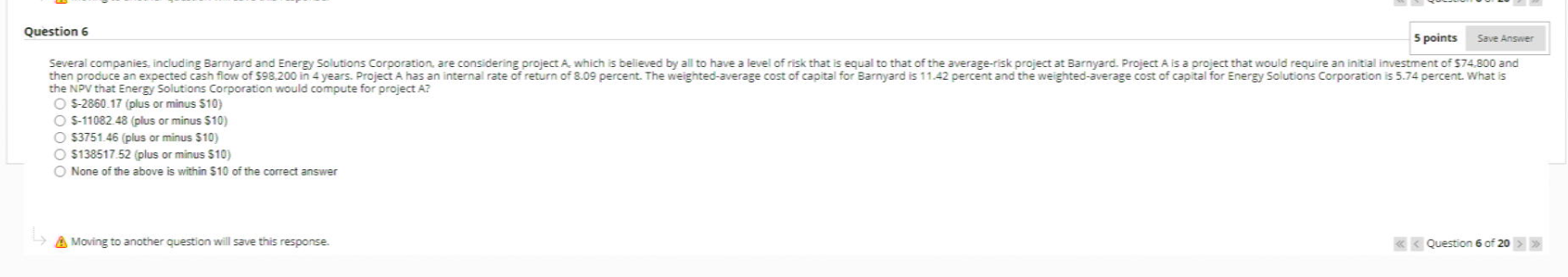

Question: Question 6 5 points Save Answer Several companies, including Barnyard and Energy Solutions Corporation, are considering project A, which is believed by all to have

Question 6 5 points Save Answer Several companies, including Barnyard and Energy Solutions Corporation, are considering project A, which is believed by all to have a level of risk that is equal to that of the average-risk project at Barnyard. Project A is a project that would require an initial investment of $74,800 and then produce an expected cash flow of $98,200 in 4 years. Project A has an internal rate of return of 8.09 percent. The weighted-average cost of capital for Barnyard is 11.42 percent and the weighted-average cost of capital for Energy Solutions Corporation is 5.74 percent. What is the NPV that Energy Solutions Corporation would compute for project A? O S-2860.17 (plus or minus $10) OS-11082.48 (plus or minus $10) O $3751.46 (plus or minus $10) O $138517.52 (plus or minus $10) O None of the above is within $10 of the correct answer A Moving to another question will save this response. >> A Moving to another question will save this response. Question 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts