Question: Question 6 5 pts Upon graduation from UCI you decide to buy a home and take out a variable-rate mortgage. The mortgage value is $500,000,

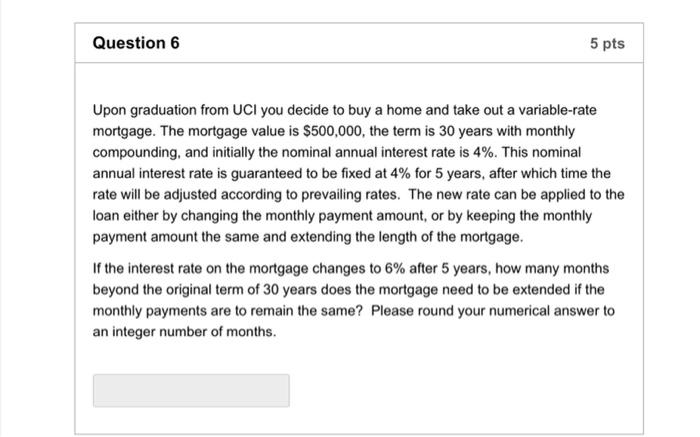

Question 6 5 pts Upon graduation from UCI you decide to buy a home and take out a variable-rate mortgage. The mortgage value is $500,000, the term is 30 years with monthly compounding, and initially the nominal annual interest rate is 4%. This nominal annual interest rate is guaranteed to be fixed at 4% for 5 years, after which time the rate will be adjusted according to prevailing rates. The new rate can be applied to the loan either by changing the monthly payment amount, or by keeping the monthly payment amount the same and extending the length of the mortgage. If the interest rate on the mortgage changes to 6% after 5 years, how many months beyond the original term of 30 years does the mortgage need to be extended if the monthly payments are to remain the same? Please round your numerical answer to an integer number of months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts