Question: Question 6 (8 marks) Part (a) (5 marks) Cary's Caravans operates a single-product entity building luxury caravans. Data relating to the product for 2020 were

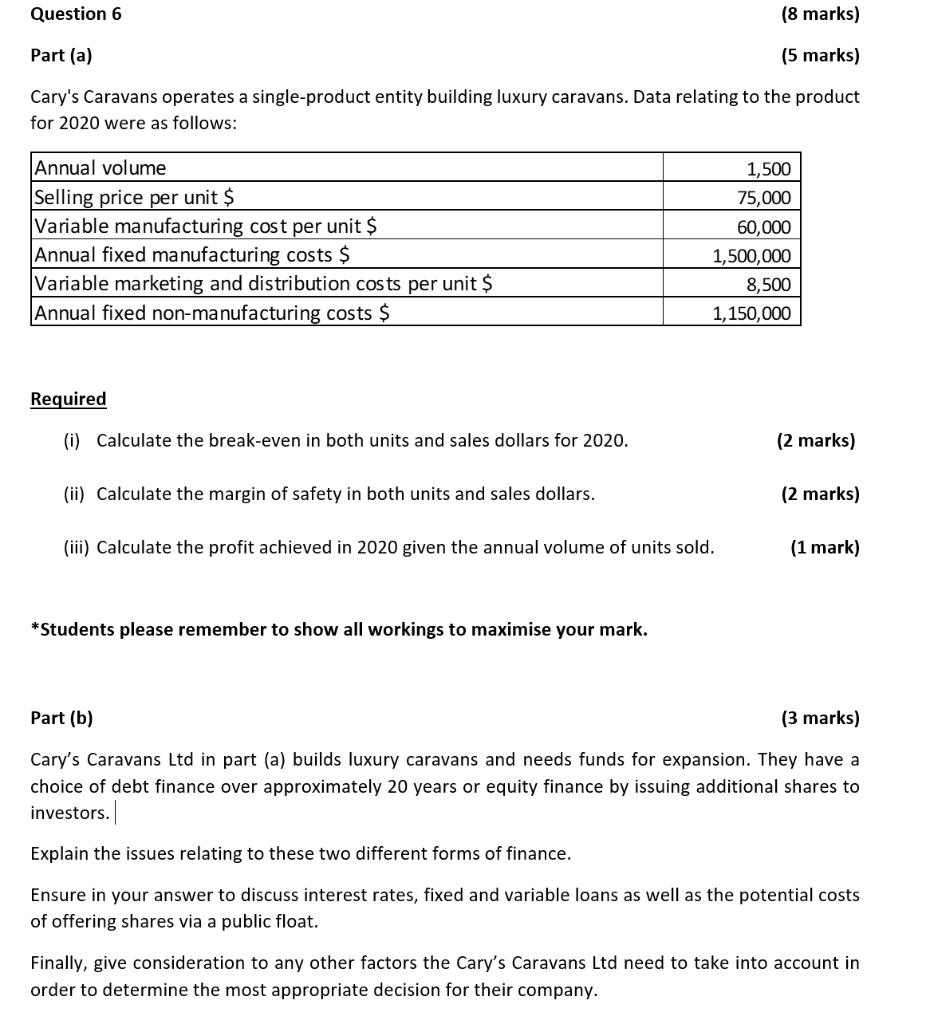

Question 6 (8 marks) Part (a) (5 marks) Cary's Caravans operates a single-product entity building luxury caravans. Data relating to the product for 2020 were as follows: 1,500 75,000 Annual volume Selling price per unit $ Variable manufacturing cost per unit $ Annual fixed manufacturing costs $ Variable marketing and distribution costs per unit $ Annual fixed non-manufacturing costs $ 60,000 1,500,000 8,500 1,150,000 Required (i) Calculate the break-even in both units and sales dollars for 2020. (2 marks) (ii) Calculate the margin of safety in both units and sales dollars. (2 marks) (iii) Calculate the profit achieved in 2020 given the annual volume of units sold. (1 mark) *Students please remember to show all workings to maximise your mark. Part (b) (3 marks) Cary's Caravans Ltd in part (a) builds luxury caravans and needs funds for expansion. They have a choice of debt finance over approximately 20 years or equity finance by issuing additional shares to investors. Explain the issues relating to these two different forms of finance. Ensure in your answer to discuss interest rates, fixed and variable loans as well as the potential costs of offering shares via a public float. Finally, give consideration to any other factors the Cary's Caravans Ltd need to take into account in order to determine the most appropriate decision for their company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts