Question: Question 6 ( 9 points ) George had $ 2 0 0 , 0 0 0 of AGI for 2 0 2 3 . He

Question points

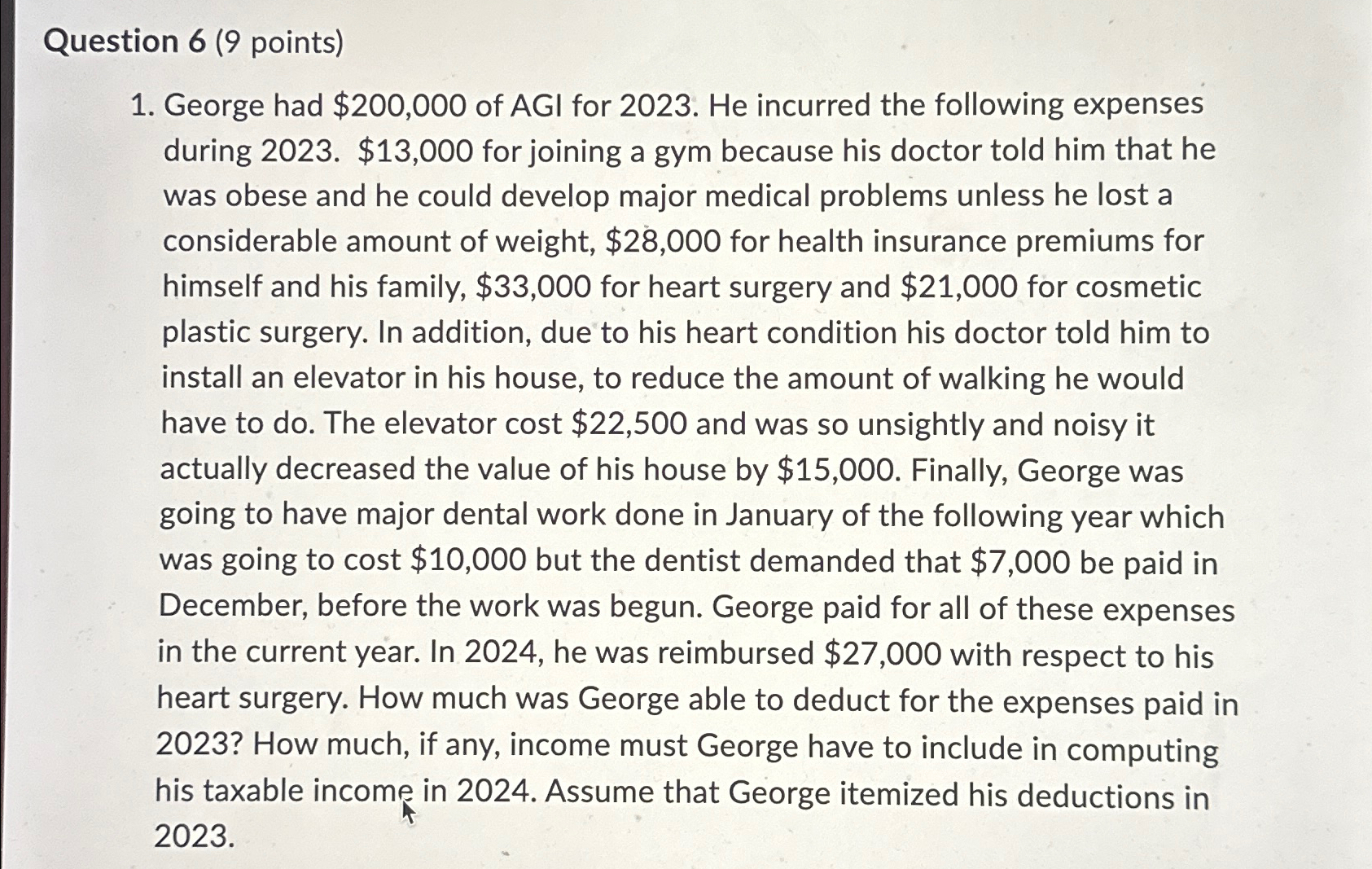

George had $ of AGI for He incurred the following expenses during $ for joining a gym because his doctor told him that he was obese and he could develop major medical problems unless he lost a considerable amount of weight, $ for health insurance premiums for himself and his family, $ for heart surgery and $ for cosmetic plastic surgery. In addition, due to his heart condition his doctor told him to install an elevator in his house, to reduce the amount of walking he would have to do The elevator cost $ and was so unsightly and noisy it actually decreased the value of his house by $ Finally, George was going to have major dental work done in January of the following year which was going to cost $ but the dentist demanded that $ be paid in December, before the work was begun. George paid for all of these expenses in the current year. In he was reimbursed $ with respect to his heart surgery. How much was George able to deduct for the expenses paid in How much, if any, income must George have to include in computing his taxable income in Assume that George itemized his deductions in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock