Question: Question 6: A company is considering three different options for a manufacturing machine for next 10 years. Options A, B and C have initial

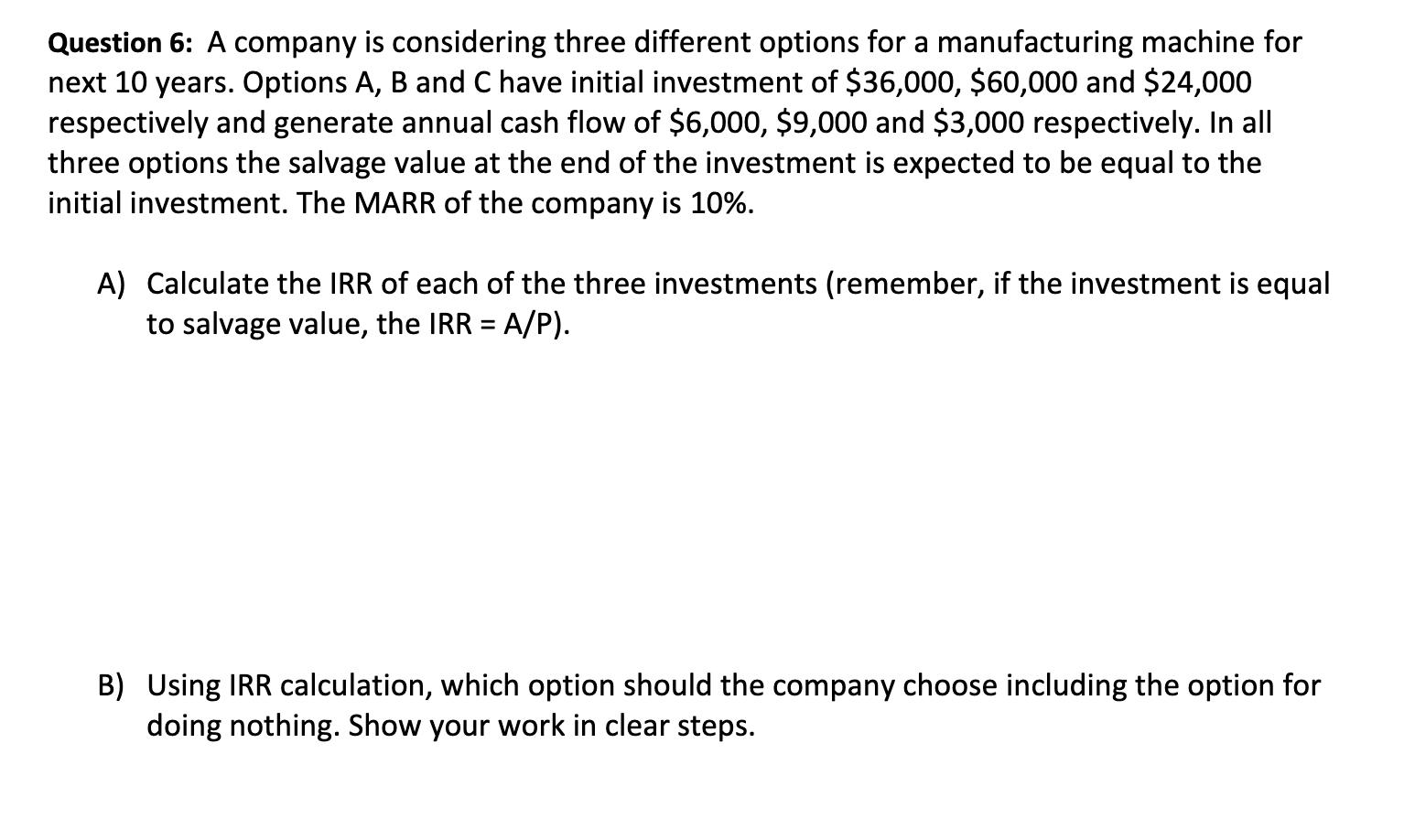

Question 6: A company is considering three different options for a manufacturing machine for next 10 years. Options A, B and C have initial investment of $36,000, $60,000 and $24,000 respectively and generate annual cash flow of $6,000, $9,000 and $3,000 respectively. In all three options the salvage value at the end of the investment is expected to be equal to the initial investment. The MARR of the company is 10%. A) Calculate the IRR of each of the three investments (remember, if the investment is equal to salvage value, the IRR = A/P). B) Using IRR calculation, which option should the company choose including the option for doing nothing. Show your work in clear steps.

Step by Step Solution

There are 3 Steps involved in it

A To calculate the Internal Rate of Return IRR for each investment option we need to find the discou... View full answer

Get step-by-step solutions from verified subject matter experts