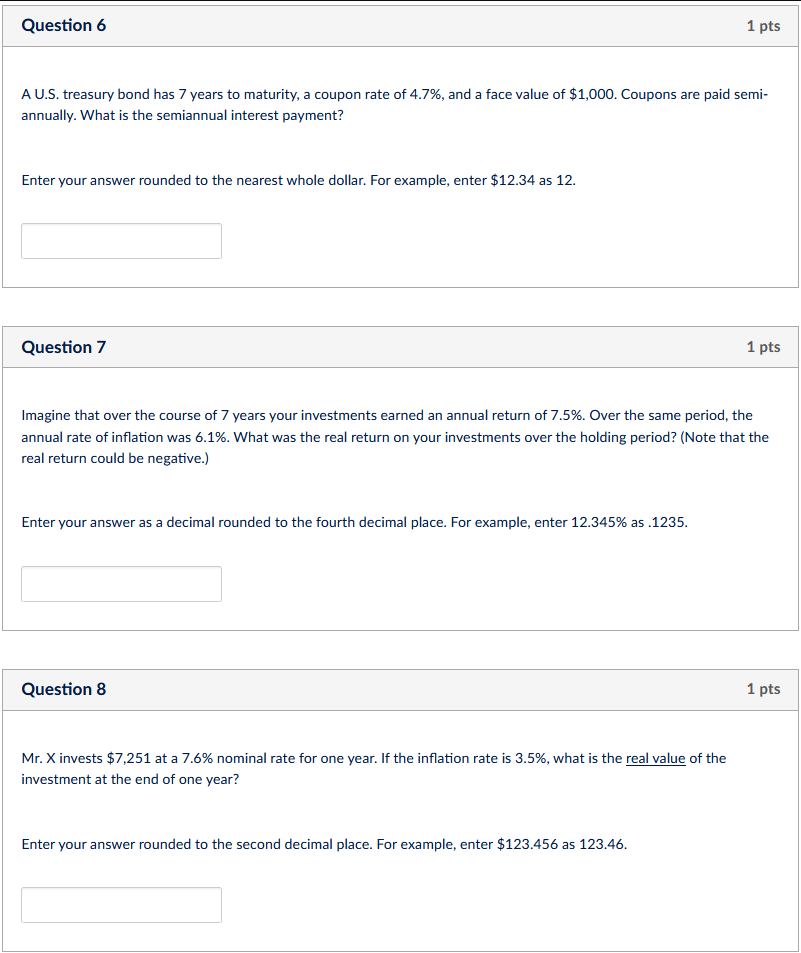

Question: Question 6 A U . S . treasury bond has 7 years to maturity, a coupon rate of 4 . 7 % , and a

Question

A US treasury bond has years to maturity, a coupon rate of and a face value of $ Coupons are paid semi

annually. What is the semiannual interest payment?

Enter your answer rounded to the nearest whole dollar. For example, enter $ as

Question

Imagine that over the course of years your investments earned an annual return of Over the same period, the

annual rate of inflation was What was the real return on your investments over the holding period? Note that the

real return could be negative.

Enter your answer as a decimal rounded to the fourth decimal place. For example, enter as

Question

Mr X invests $ at a nominal rate for one year. If the inflation rate is what is the real value of the

investment at the end of one year?

Enter your answer rounded to the second decimal place. For example, enter $ as

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock