Question: Question 6 Abbott placed into service a flexible manufacturing cell costing $850,000 early this year for production of their analytical testing equipment. Gross income due

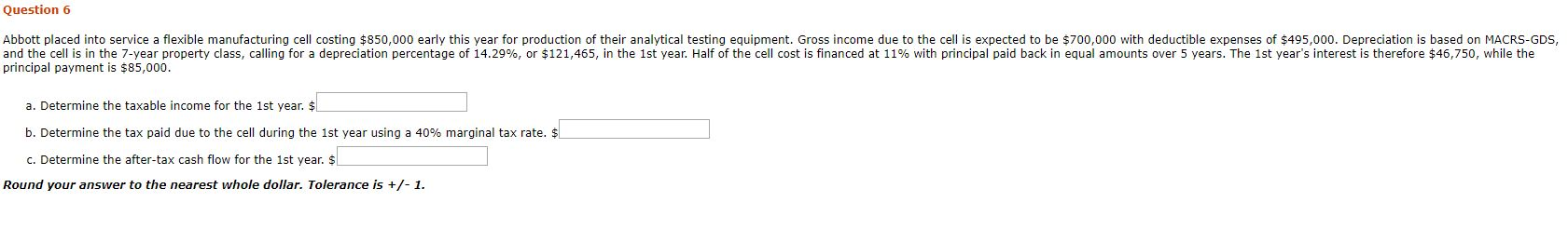

Question 6 Abbott placed into service a flexible manufacturing cell costing $850,000 early this year for production of their analytical testing equipment. Gross income due to the cell is expected to be $700,000 with deductible expenses of $495,000. Depreciation is based on MACRS-GDS, and the cell is in the 7-year property class, calling for a depreciation percentage of 14.29%, or $121,465, in the 1st year. Half of the cell cost is financed at 11% with principal paid back in equal amounts over 5 years. The 1st year's interest is therefore $46,750, while the principal payment is $85,000. a. Determine the taxable income for the 1st year. $ b. Determine the tax paid due to the cell during the 1st year using a 40% marginal tax rate. $L c. Determine the after-tax cash flow for the 1st year. $ Round your answer to the nearest whole dollar. Tolerance is +/- 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts