Question: Question 6: ABC Co. is considering replacing an old computer with a new one. The old one was purchased 1 year ago for $600,000. It

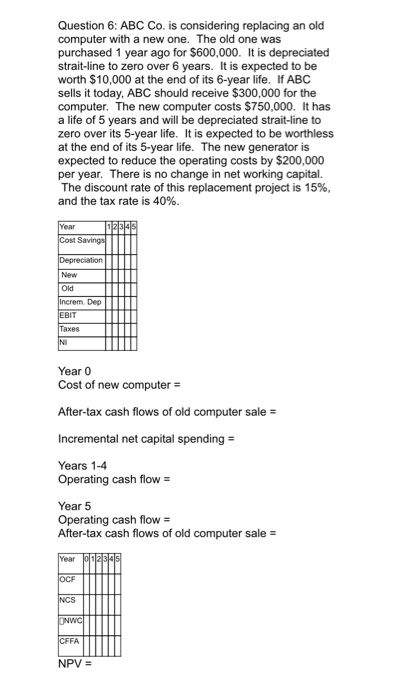

Question 6: ABC Co. is considering replacing an old computer with a new one. The old one was purchased 1 year ago for $600,000. It is depreciated strait-line to zero over 6 years. It is expected to be worth $10,000 at the end of its 6-year life. If ABC sells it today, ABC should receive $300, 000 for the computer. The new computer costs $750,000. It has a life of 5 years and will be depreciated strait-line to zero over its 5-year life. It is expected to be worthless at the end of its 5-year life. The new generator is expected to reduce the operating costs by $200,000 per year. There is no change in net working capital. The discount rate of this replacement project is 15%, and the tax rate is 40 %. Year 12345 Cost Savings Depreciation New Old Increm, Dep EBIT Taxes NI Year 0 Cost of new computer After-tax cash flows of old computer sale Incremental net capital spending = Years 1-4 Operating cash flow Year 5 Operating cash flow After-tax cash flows of old computer sale Year 12345 OCF NCS NWC CFFA NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts