Question: Question 6: Accounting Errors (4 marks) SPECIFIC INSTRUCTIONS: Only the BLUE CELLS will be marked. All journal entries must have Debits listed first before Credits.

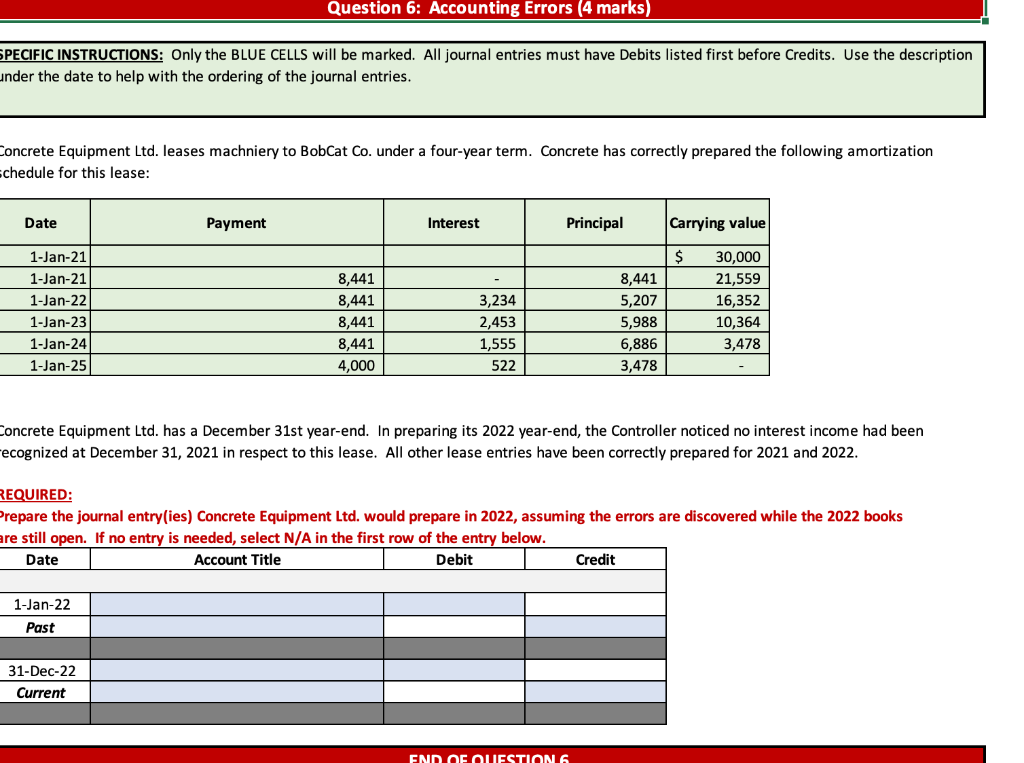

Question 6: Accounting Errors (4 marks) SPECIFIC INSTRUCTIONS: Only the BLUE CELLS will be marked. All journal entries must have Debits listed first before Credits. Use the description under the date to help with the ordering of the journal entries. Concrete Equipment Ltd. leases machniery to BobCat Co. under a four-year term. Concrete has correctly prepared the following amortization chedule for this lease: Date Payment Interest Principal Carrying value $ 1-Jan-21 1-Jan-21 1-Jan-22 1-Jan-23 1-Jan-24 1-Jan-25 8,441 8,441 8,441 8,441 4,000 3,234 2,453 1,555 522 8,441 5,207 5,988 6,886 3,478 30,000 21,559 16,352 10,364 3,478 Concrete Equipment Ltd. has a December 31st year-end. In preparing its 2022 year-end, the Controller noticed no interest income had been ecognized at December 31, 2021 in respect to this lease. All other lease entries have been correctly prepared for 2021 and 2022. REQUIRED: Prepare the journal entry(ies) Concrete Equipment Ltd. would prepare in 2022, assuming the errors are discovered while the 2022 books are still open. If no entry is needed, select N/A in the first row of the entry below. Date Account Title Debit Credit 1-Jan-22 Past 31-Dec-22 Current END OF OUESTION 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts