Question: Question 6 Answer all parts (a) Critically evaluate the differences between presentation currency and functional curreny. (4 marks) (b) Briefly explain the factors for determining

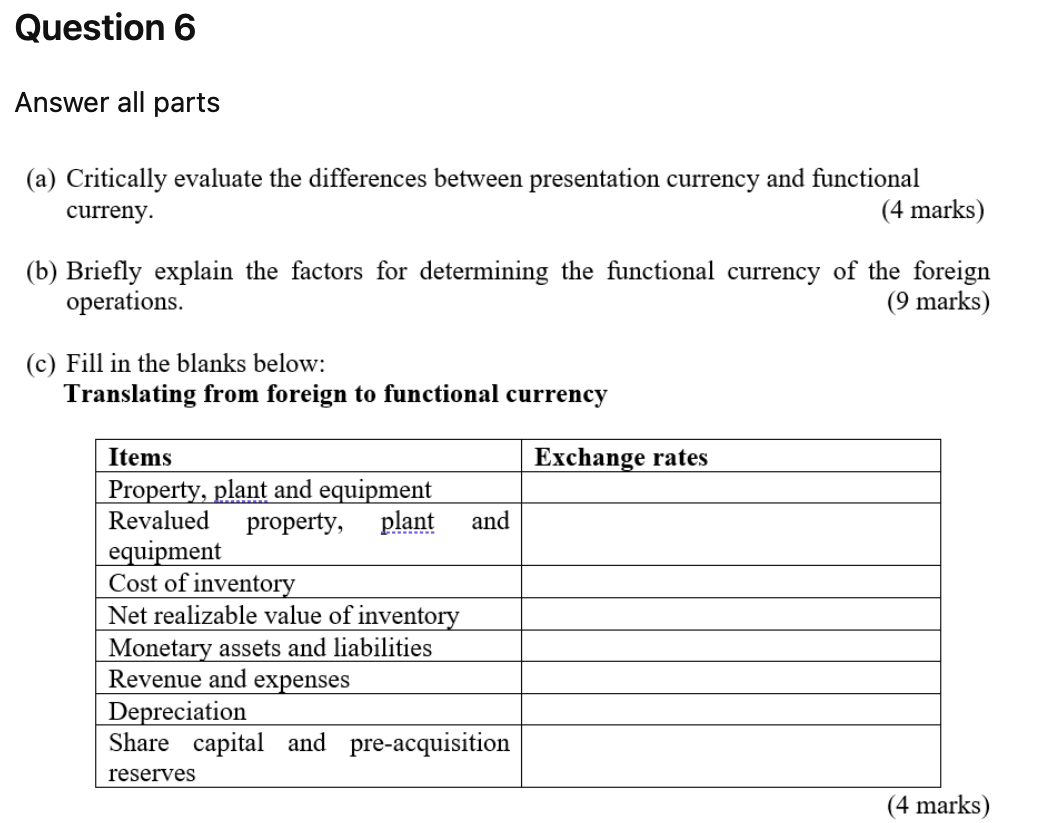

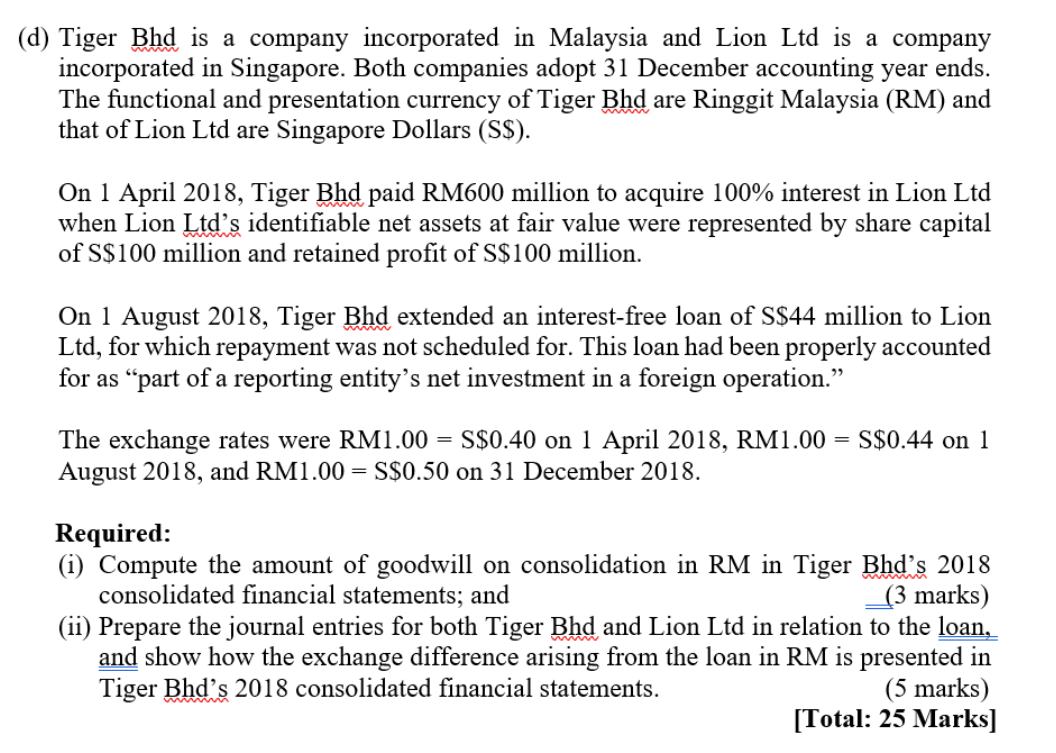

Question 6 Answer all parts (a) Critically evaluate the differences between presentation currency and functional curreny. (4 marks) (b) Briefly explain the factors for determining the functional currency of the foreign operations. (9 marks) (c) Fill in the blanks below: Translating from foreign to functional currency Exchange rates Items Property, plant and equipment Revalued property, plant and equipment Cost of inventory Net realizable value of inventory Monetary assets and liabilities Revenue and expenses Depreciation Share capital and pre-acquisition reserves (4 marks) (d) Tiger Bhd is a company incorporated in Malaysia and Lion Ltd is a company incorporated in Singapore. Both companies adopt 31 December accounting year ends. The functional and presentation currency of Tiger Bhd are Ringgit Malaysia (RM) and that of Lion Ltd are Singapore Dollars (S$). On 1 April 2018, Tiger Bhd paid RM600 million to acquire 100% interest in Lion Ltd when Lion Ltds identifiable net assets at fair value were represented by share capital of S$100 million and retained profit of S$100 million. On 1 August 2018, Tiger Bhd extended an interest-free loan of S$44 million to Lion Ltd, for which repayment was not scheduled for. This loan had been properly accounted for as part of a reporting entity's net investment in a foreign operation. The exchange rates were RM1.00 = S$0.40 on 1 April 2018, RM1.00 = S$0.44 on 1 August 2018, and RM1.00 = S$0.50 on 31 December 2018. Required: (i) Compute the amount of goodwill on consolidation in RM in Tiger Bhd's 2018 consolidated financial statements; and (3 marks) (ii) Prepare the journal entries for both Tiger Bhd and Lion Ltd in relation to the loan, and show how the exchange difference arising from the loan in RM is presented in Tiger Bhd's 2018 consolidated financial statements. (5 marks) [Total: 25 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts