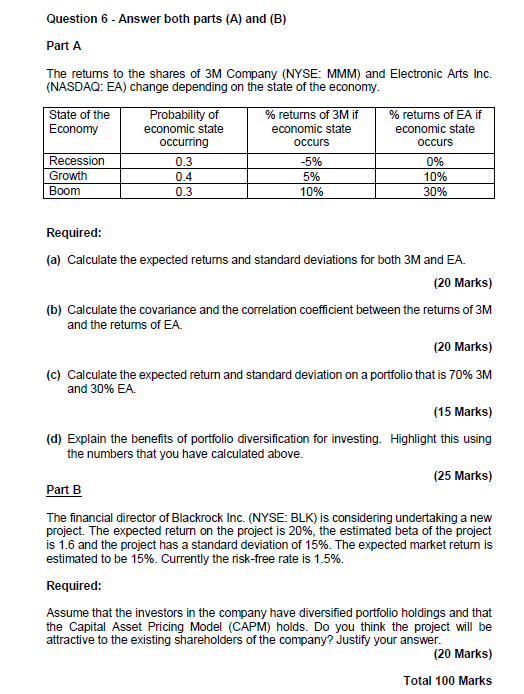

Question: Question 6 - Answer both parts (A) and (B) Part A The returns to the shares of 3M Company (NYSE: MMM) and Electronic Arts Inc.

Question 6 - Answer both parts (A) and (B) Part A The returns to the shares of 3M Company (NYSE: MMM) and Electronic Arts Inc. (NASDAQ: EA) change depending on the state of the economy. State of the Probability of % returns of 3M if % returns of EA if Economy economic state economic state economic state occurring occurs occurs Recession 0.3 -5% 0% Growth 0.4 5% 10% Boom 0.3 10% 30% Required: (a) Calculate the expected returns and standard deviations for both 3M and EA. (20 Marks) (b) Calculate the covariance and the correlation coefficient between the returns of 3M and the returns of EA (20 Marks) (c) Calculate the expected return and standard deviation on a portfolio that is 70% 3M and 30% EA (15 Marks) (d) Explain the benefits of portfolio diversification for investing. Highlight this using the numbers that you have calculated above. (25 Marks) Part B The financial director of Blackrock Inc. (NYSE: BLK) is considering undertaking a new project. The expected return on the project is 20%, the estimated beta of the project is 1.6 and the project has a standard deviation of 15%. The expected market return is estimated to be 15%. Currently the risk-free rate is 1.5%. Required: Assume that the investors in the company have diversified portfolio holdings and that the Capital Asset Pricing Model (CAPM) holds. Do you think the project will be attractive to the existing shareholders of the company? Justify your answer. (20 Marks) Total 100 Marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts