Question: Question 6 Answer the following questions briefly (3 marks each): a) What is the current yield of a bond that sells for $800 and has

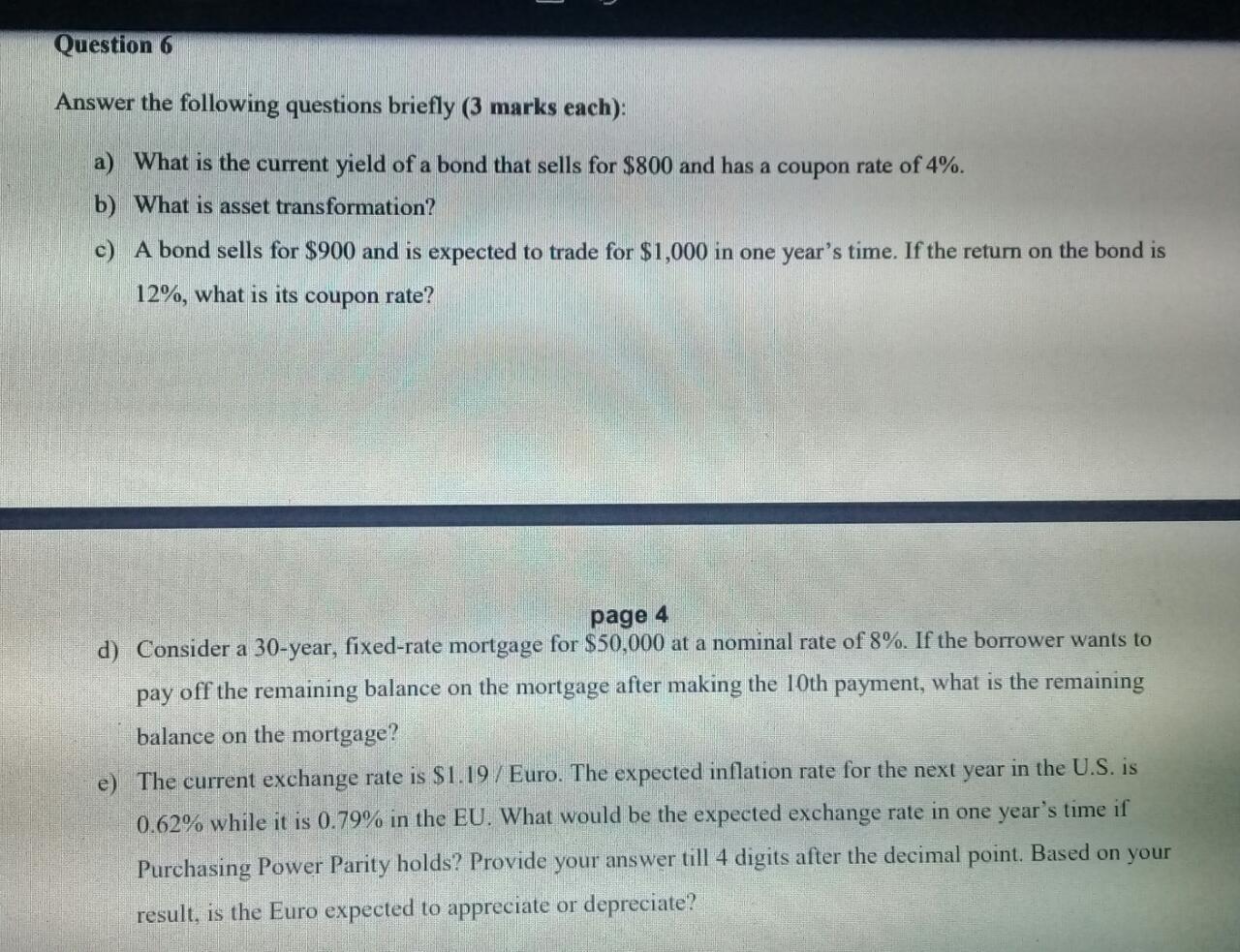

Question 6 Answer the following questions briefly (3 marks each): a) What is the current yield of a bond that sells for $800 and has a coupon rate of 4%. b) What is asset transformation? c) A bond sells for $900 and is expected to trade for $1,000 in one year's time. If the return on the bond is 12%, what is its coupon rate? page 4 d) Consider a 30-year, fixed-rate mortgage for $50,000 at a nominal rate of 8%. If the borrower wants to pay off the remaining balance on the mortgage after making the 10th payment, what is the remaining balance on the mortgage? e) The current exchange rate is $1.19 / Euro. The expected inflation rate for the next year in the U.S.is 0.62% while it is 0.79% in the EU. What would be the expected exchange rate in one year's time if Purchasing Power Parity holds? Provide your answer till 4 digits after the decimal point. Based on your result, is the Euro expected to appreciate or depreciate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts