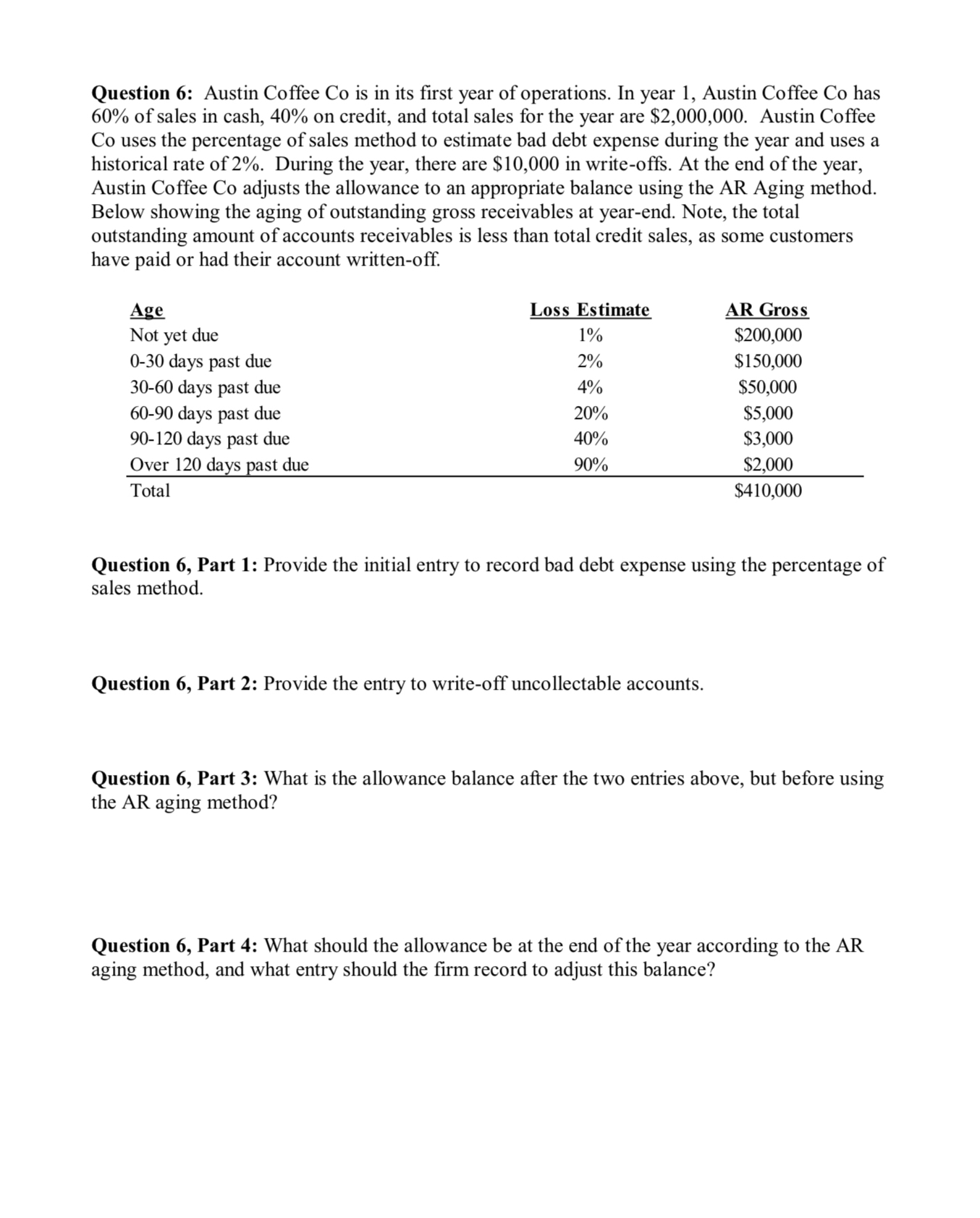

Question: Question 6 : Austin Coffee Co is in its first year of operations. In year 1 , Austin Coffee Co has 6 0 % of

Question : Austin Coffee Co is in its first year of operations. In year Austin Coffee Co has

of sales in cash, on credit, and total sales for the year are $ Austin Coffee

Co uses the percentage of sales method to estimate bad debt expense during the year and uses a

historical rate of During the year, there are $ in writeoffs. At the end of the year,

Austin Coffee Co adjusts the allowance to an appropriate balance using the AR Aging method.

Below showing the aging of outstanding gross receivables at yearend. Note, the total

outstanding amount of accounts receivables is less than total credit sales, as some customers

have paid or had their account writtenoff.

Age

Not yet due

days past due

days past due

days past due

days past due

Over days past due

Total

Loss Estimate

$

$

$

$

$

$

Question Part : Provide the initial entry to record bad debt expense using the percentage of

sales method.

Question Part : Provide the entry to writeoff uncollectable accounts.

Question Part : What is the allowance balance after the two entries above, but before using

the AR aging method?

Question Part : What should the allowance be at the end of the year according to the AR

aging method, and what entry should the firm record to adjust this balance?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock