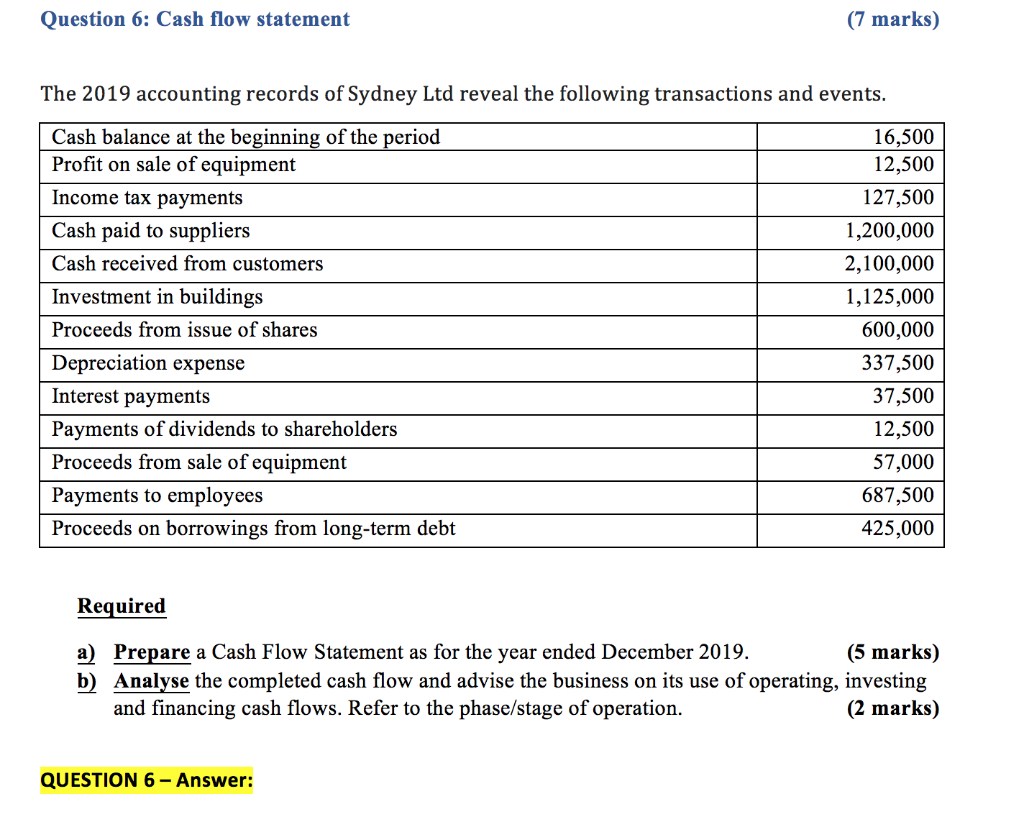

Question: Question 6: Cash flow statement (7 marks) The 2019 accounting records of Sydney Ltd reveal the following transactions and events. Cash balance at the beginning

Question 6: Cash flow statement (7 marks) The 2019 accounting records of Sydney Ltd reveal the following transactions and events. Cash balance at the beginning of the period Profit on sale of equipment Income tax payments Cash paid to suppliers Cash received from customers Investment in buildings Proceeds from issue of shares Depreciation expense Interest payments Payments of dividends to shareholders Proceeds from sale of equipment Payments to employees Proceeds on borrowings from long-term debt 16,500 12,500 127,500 1,200,000 2,100,000 1,125,000 600,000 337,500 37,500 12,500 1,00 687,500 425,000 Required a) Prepare a Cash Flow Statement as for the year ended December 2019. (5 marks) b) Analyse the completed cash flow and advise the business on its use of operating, investing and financing cash flows. Refer to the phase/stage of operation. (2 marks) QUESTION 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts