Question: QUESTION 6 ( CHAPTER 1 8 ) Melissa transfers the following assets to Moser Corporation in exchange for all of its stock. Assume that neither

QUESTION CHAPTER

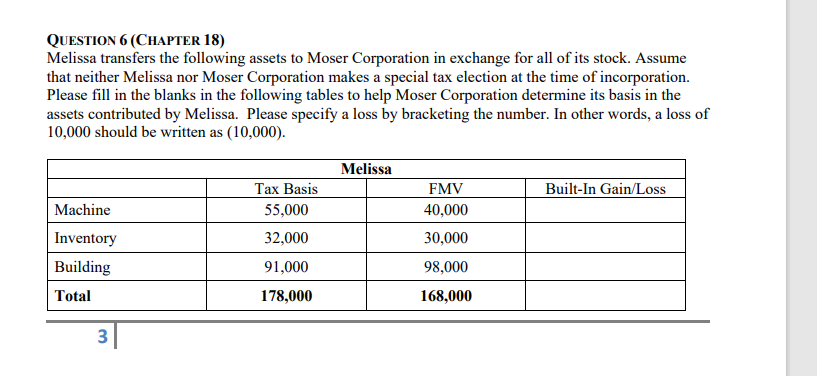

Melissa transfers the following assets to Moser Corporation in exchange for all of its stock. Assume that neither Melissa nor Moser Corporation makes a special tax election at the time of incorporation. Please fill in the blanks in the following tables to help Moser Corporation determine its basis in the assets contributed by Melissa. Please specify a loss by bracketing the number. In other words, a loss of should be written as

tableMelissaTax Basis,FMVBuiltIn GainLossMachineInventoryBuildingTotal

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock