Question: Question 6 comes first and question 8 is corresponding to it 8. Calculating NPV (L01) For the cash flows in the previous problem, suppose the

Question 6 comes first and question 8 is corresponding to it

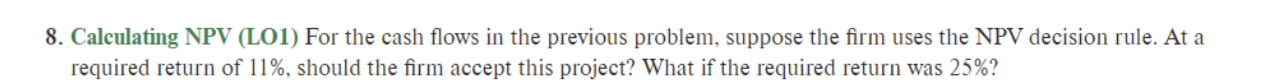

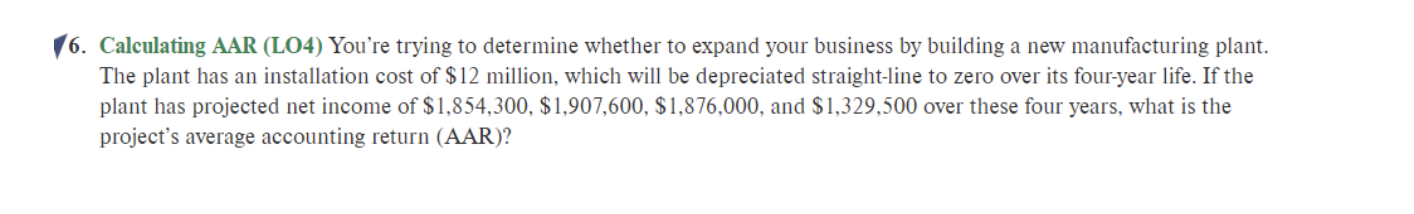

8. Calculating NPV (L01) For the cash flows in the previous problem, suppose the firm uses the NPV decision rule. At a required return of 11%, should the firm accept this project? What if the required return was 25%? 16. Calculating AAR (LO4) You're trying to determine whether to expand your business by building a new manufacturing plant. The plant has an installation cost of $12 million, which will be depreciated straight-line to zero over its four-year life. If the plant has projected net income of $1,854,300, $1,907,600, $1,876,000, and $1,329,500 over these four years, what is the project's average accounting return (AAR)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts