Question: Question 6: Comparison Methods Part 2 (9 marks) Fantastic Footware is looking to invest in a number of pieces of new equipment this year. The

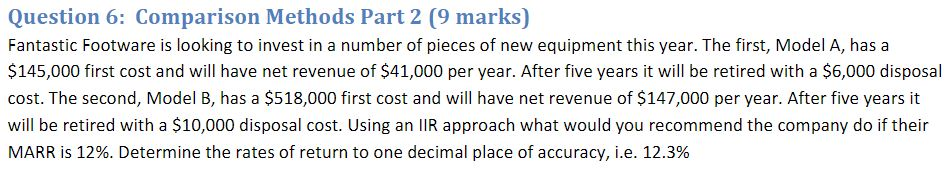

Question 6: Comparison Methods Part 2 (9 marks) Fantastic Footware is looking to invest in a number of pieces of new equipment this year. The first, Model A, has a $145,000 first cost and will have net revenue of $41,000 per year. After five years it will be retired with a $6,000 disposal cost. The second, Model B, has a $518,000 first cost and will have net revenue of $147,000 per year. After five years it will be retired with a $10,000 disposal cost. Using an IIR approach what would you recommend the company do if their MARR is 12%. Determine the rates of return to one decimal place of accuracy, i.e. 12.3%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock