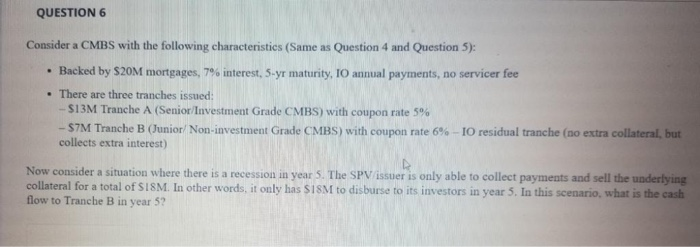

Question: QUESTION 6 Consider a CMBS with the following characteristics (Same as Question 4 and Question 5): Backed by $20M mortgages, 7% interest, 5-yT maturity, IO

QUESTION 6 Consider a CMBS with the following characteristics (Same as Question 4 and Question 5): Backed by $20M mortgages, 7% interest, 5-yT maturity, IO annual payments, no servicer fee There are three tranches issued: $13M Tranche A (Senior/Investment Grade CMBS) with coupon rate 5% - S7M Tranche B (Junior/ Non-investment Grade CMBS) with coupon rate 6% - 10 residual tranche (no extra collateral, but collects extra interest) Now consider a situation where there is a recession in year 5. The SPV/issuer is only able to collect payments and sell the underlying collateral for a total of SISM. In other words, it only has $1SM to disburse to its investors in year 5. In this scenario, what is the cash flow to Tranche B in year 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts