Question: Question 6 Davis Machine Works purchased a stamping machine for ( $ 1 3 5 , 0 0 0 ) on February

Question

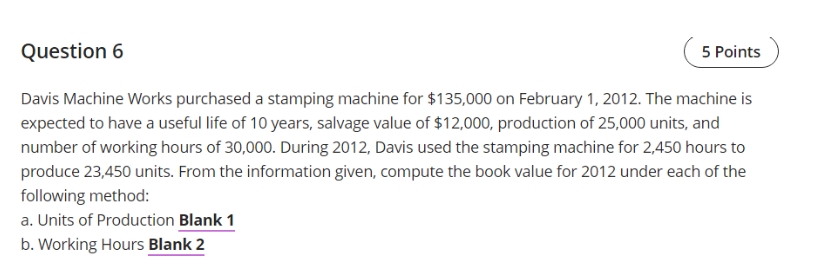

Davis Machine Works purchased a stamping machine for $ on February The machine is expected to have a useful life of years, salvage value of $ production of units, and number of working hours of During Davis used the stamping machine for hours to produce units. From the information given, compute the book value for under each of the following method:

a Units of Production Blank

b Working Hours Blank

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock