Question: Question 6 Hank Schrader, a DEA agent, has recently seized illegal weapons and drugs valued at USD 10 million. As a reward for his services

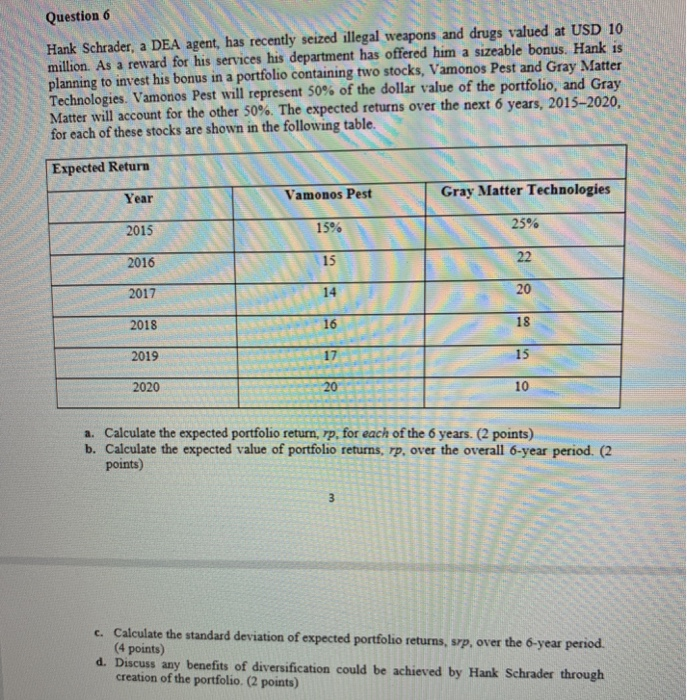

Question 6 Hank Schrader, a DEA agent, has recently seized illegal weapons and drugs valued at USD 10 million. As a reward for his services his department has offered him a sizeable bonus. Hank is planning to invest his bonus in a portfolio containing two stocks, Vamonos Pest and Gray Matter Technologies. Vamonos Pest will represent 50% of the dollar value of the portfolio, and Gray Matter will account for the other 50%. The expected returns over the next 6 years, 2015-2020, for each of these stocks are shown in the following table. Expected Return Year Vamonos Pest Gray Matter Technologies 2015 15% 25% 2016 15 22 2017 14 20 2018 16 18 2019 17 15 2020 20 10 a. Calculate the expected portfolio return, rp, for each of the 6 years. (2 points) b. Calculate the expected value of portfolio returns, rp. over the overall 6-year period. (2 points) 3 c. Calculate the standard deviation of expected portfolio returns, srp, over the 6-year period. (4 points) d. Discuss any benefits of diversification could be achieved by Hank Schrader through creation of the portfolio (2 points) Question 6 Hank Schrader, a DEA agent, has recently seized illegal weapons and drugs valued at USD 10 million. As a reward for his services his department has offered him a sizeable bonus. Hank is planning to invest his bonus in a portfolio containing two stocks, Vamonos Pest and Gray Matter Technologies. Vamonos Pest will represent 50% of the dollar value of the portfolio, and Gray Matter will account for the other 50%. The expected returns over the next 6 years, 2015-2020, for each of these stocks are shown in the following table. Expected Return Year Vamonos Pest Gray Matter Technologies 2015 15% 25% 2016 15 22 2017 14 20 2018 16 18 2019 17 15 2020 20 10 a. Calculate the expected portfolio return, rp, for each of the 6 years. (2 points) b. Calculate the expected value of portfolio returns, rp. over the overall 6-year period. (2 points) 3 c. Calculate the standard deviation of expected portfolio returns, srp, over the 6-year period. (4 points) d. Discuss any benefits of diversification could be achieved by Hank Schrader through creation of the portfolio (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts