Question: QUESTION 6 How do High Frequency Traders gan market advantage? They use sophisticated models to track trends and trade ahead of those trends By trading

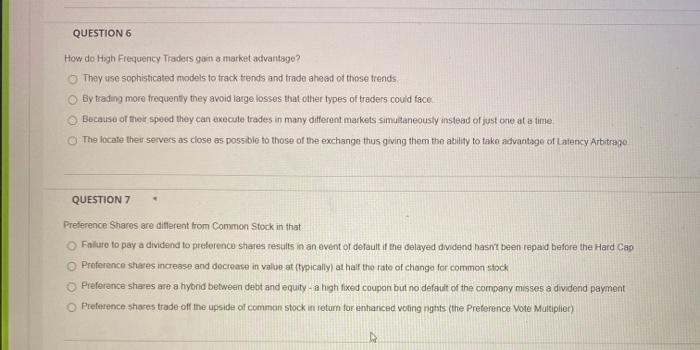

QUESTION 6 How do High Frequency Traders gan market advantage? They use sophisticated models to track trends and trade ahead of those trends By trading more frequently they avoid large losses that other types of traders could face Because of their spoed they can execute trades in many different markets simultaneously instead of just one at a time The locate their servers as close as possible to those of the exchange thus giving them the ability to take advantage of Latency Arbitrage QUESTION 7 Preference Shares are different from Common Stock in that Falute to pay a dividend to preference shares results in an event or default if the delayed dividend hasn't been repaid before the Hard Cap Preference shares increase and decrease in value at(typically) at half the rate of change for common stock Preference shares are a hybrid between debt and equity- a high fixed coupon but no default of the company misses a dividend payment Preference shares trade off the upside of common stock in return for enhanced voting nights (the Preference Vote Multiplier)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts