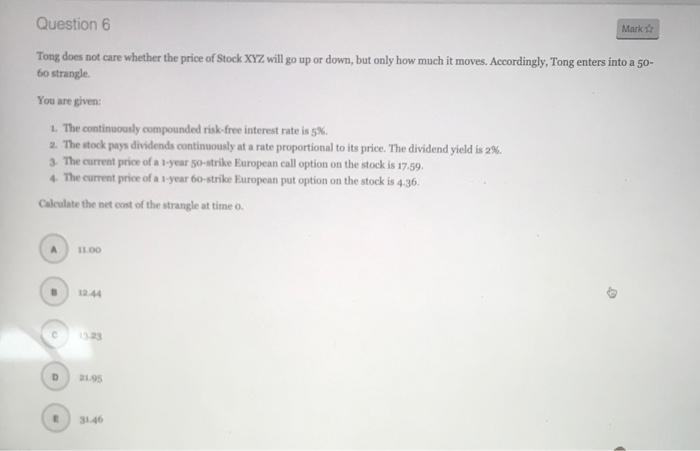

Question: Question 6 Mark Tong does not care whether the price of Stock XYZ will go up or down, but only how much it moves. Accordingly,

Question 6 Mark Tong does not care whether the price of Stock XYZ will go up or down, but only how much it moves. Accordingly, Tong enters into a 50- 60 strangle. You are given: 1. The continuously compounded risk-free interest rate is 5%. 2. The stock pays dividends continuously at a rate proportional to its price. The dividend yield is 2% 3. The current price of a 1-year 50-strike European call option on the stock is 17,59 4. The current price of a 1-year 60-strike European put option on the stock is 4.36. Calculate the net cost of the strangle at time o. 11.00 D 19 31:40

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock