Question: Question 6: (Max 25 marks) You are the manager tasked to review the liquidity and working capital management of the company You received the following

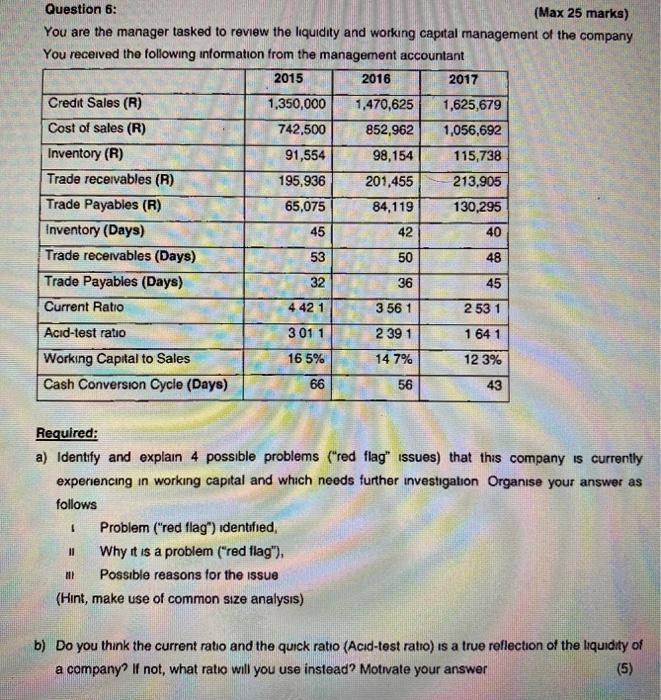

Question 6: (Max 25 marks) You are the manager tasked to review the liquidity and working capital management of the company You received the following information from the management accountant 2015 2016 2017 Credit Sales (R) 1,350,000 1,470,625 1,625,679 Cost of sales (R) 742,500 852,962 1,056,692 Inventory (R) 91,554 98,154 115,738 Trade receivables (R) 195,936 201,455 213,905 Trade Payables (R) 65,075 84,119 130,295 Inventory (Days) 45 42 40 Trade receivables (Days) 53 50 48 Trade Payables (Days) 32 36 45 Current Ratio 4 42 1 3 561 2 53 1 Acid-test ratio 301 1 2391 1 64 1 Working Capital to Sales 16 5% 14 7% 12 3% Cash Conversion Cycle (Days) 66 56 43 Required: a) Identify and explain 4 possible problems ("red flag" issues) that this company is currently experiencing in working capital and which needs further investigation Organise your answer as follows Problem ("red flag") identified, Why it is a problem ("red flag"). Possible reasons for the issue (Hint, make use of common size analysis) II MI b) Do you think the current ratio and the quick ratio (Acid-test ratio) is a true reflection of the liquidity of a company? If not, what ratio will you use instead? Motivate your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts