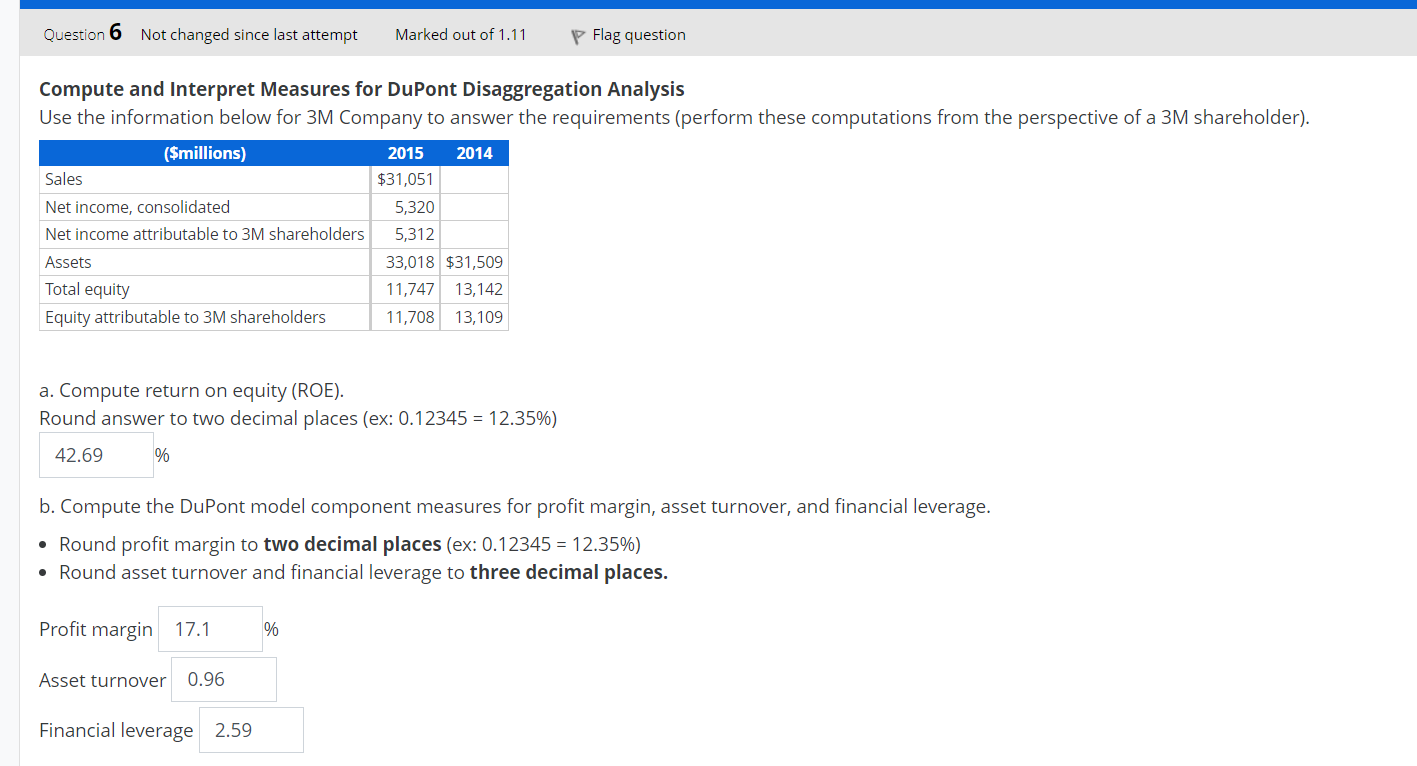

Question: Question 6 Not changed since last attempt Marked out of 1.11 Flag question Compute and Interpret Measures for DuPont Disaggregation Analysis Use the information

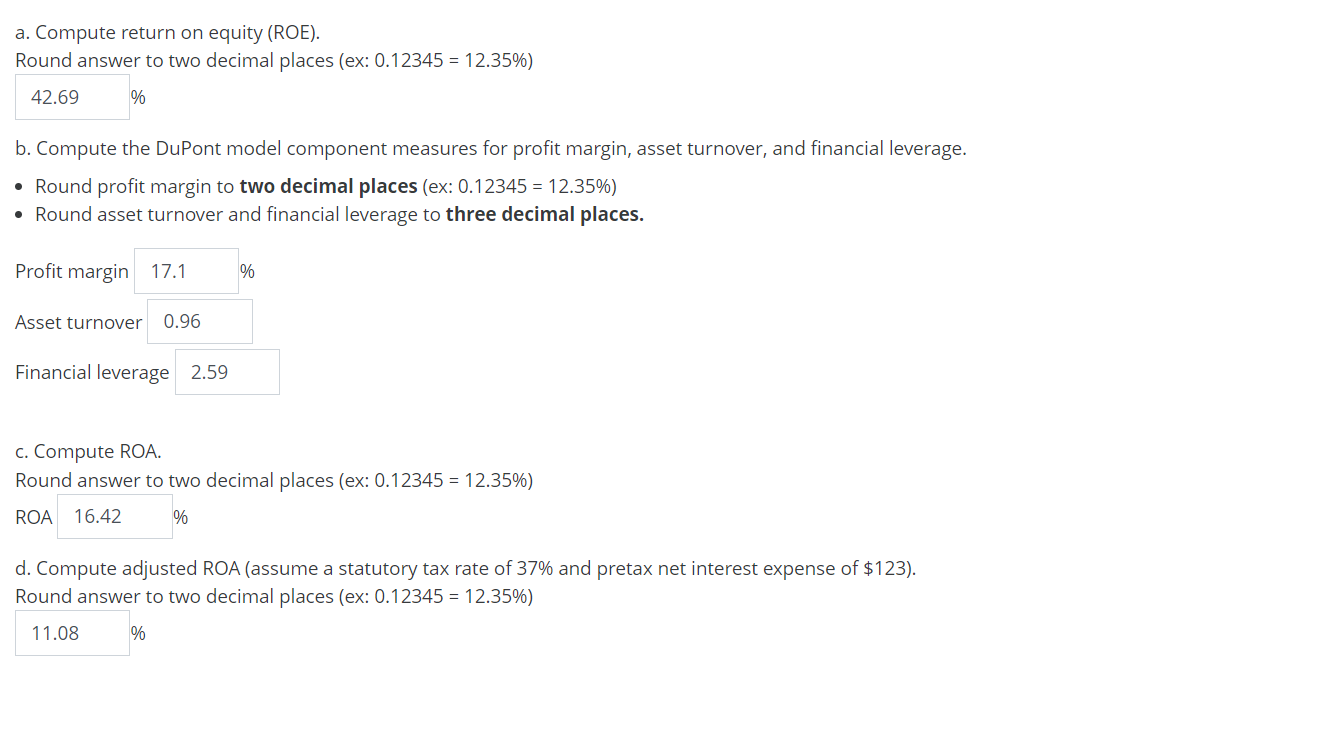

Question 6 Not changed since last attempt Marked out of 1.11 Flag question Compute and Interpret Measures for DuPont Disaggregation Analysis Use the information below for 3M Company to answer the requirements (perform these computations from the perspective of a 3M shareholder). Sales ($millions) Net income, consolidated 2014 2015 $31,051 5,320 Net income attributable to 3M shareholders Assets 5,312 33,018 $31,509 Total equity 11,747 13,142 Equity attributable to 3M shareholders 11,708 13,109 a. Compute return on equity (ROE). Round answer to two decimal places (ex: 0.12345 = 12.35%) 42.69 % b. Compute the DuPont model component measures for profit margin, asset turnover, and financial leverage. Round profit margin to two decimal places (ex: 0.12345 = 12.35%) Round asset turnover and financial leverage to three decimal places. Profit margin 17.1 % Asset turnover 0.96 Financial leverage 2.59

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts