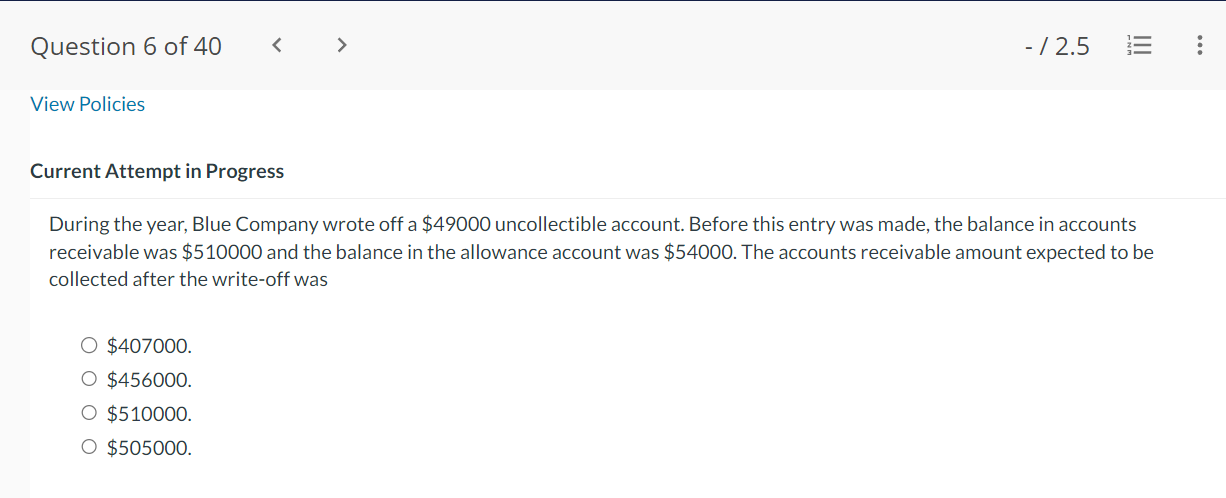

Question: Question 6 of40 - / 2.5 E View Policies Current Attempt in Progress During the year, Blue Company wrote off a $49000 uncollectible account. Before

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock