Question: question 6 parts a & b please using the financial statements attached. thank you!! 6. [Multi-Year Financial Statement Projections) The Minoso Corporation anticipates a 20

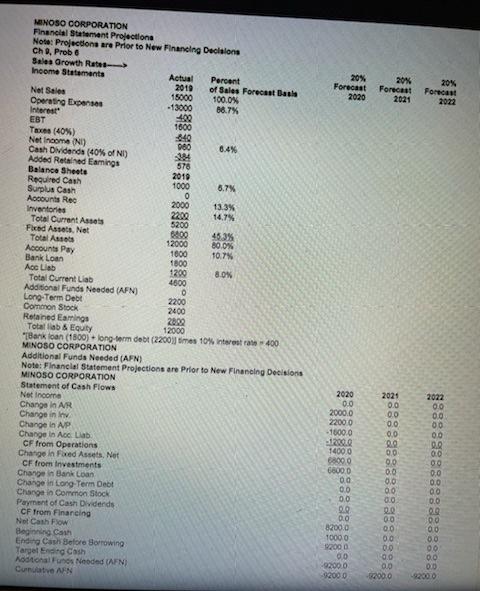

6. [Multi-Year Financial Statement Projections) The Minoso Corporation anticipates a 20 per- cent increase in sales for 2020, 2021, and 2022. Minoso is currently operating at full capac- ity and thus expects to increase its investment in both current and fixed assets in order to support the increase in forecasted sales. The Minoso Corporation's 2019 income and bal- ance sheet statements are given in problem 4. A. Prepare an Excel spreadsheet model that projects the income statement, balance sheet, and statement of cash flows for 2020 prior to obtaining any additional financ- ing. Use a separate AFN long-term financing liability/equity) account to show the amount of financing needed to make the balance sheet balance. Extend your 2020 spreadsheet-based financial statement projections for two addi- tional years (2021 and 2022). What is the total amount of AFN needed over the three- year period? c. Show how your spreadsheet model projections will change if the AFN from Part B is financed by issuing additional long-term debt at a 10 percent interest rate . 20% Forecast 2020 20% Forecast 2021 20% Forecast 2022 2019 MINOSO CORPORATION Financial Statement Projections Nota: Projections are Prior to New Financing Decisions Ch 2, Probo Sales Growth Raat Income Statements Actual Percent 2010 Net Sales of Sales Forecast Basi 15000 100.0% Operating Expenses - 13000 88.7% Interest 409 1600 Taxes (40%) Net Income (N) 849 080 6.4% Cash Dividends (40% of NI) 184 Added Retailed Eamings 576 Balance Sheets Required Cash 1000 8.7% Surplus Cash Account Rec 2000 13.3% Inventories 14.7% Total Current Assets Fixed Assets, Net 840 Total Assets 12000 80.0% Accounts Pay 1000 10.7% Bank Loan 1800 Ace Lab 1200 8.0% Total Current List 4600 Additional Funds Needed (AFN) 0 Long-Term Debt Common Stock 2400 Retained Earrings 280 Totalflab & Equity 12000 "Bank loan (1800) - long-term debt (2200 times 10% interest rate 400 MINOSO CORPORATION Additional Funds Needed (AFN) Note: Financial Statement Projections are Prior to New Financing Decisions MINOSO CORPORATION Statement of Cash Flow Net Income Change in AR Change in Change in AP Change in Acc Lab CF from Operations Change in Fred Assets, Net CF from investments Change in Bank Loan Change in Long-Term Debt Change in Common Stock Payment of Cash Dividends CF from Financing Net Cash Flow Beginning Can Ending Cash Before Borrowing Taryel Ending Cash Kodtional Funds Needed (AFN) Cute AFN 2200 2020 0.0 2000.0 22000 - 16000 12000 1400.0 68000 6800,0 0.0 0.0 0.0 DO 0.0 8200.0 10000 12000 00 -9200.0 -92000 2021 0.0 0.0 0.0 0.0 00 00 00 0.0 0.0 0.0 00 00 00 0.0 0.0 0.0 0.0 0.0 -2000 2022 0.0 0.0 00 00 0.0 00 00 00 0.0 00 0.0 00 00 00 00 0.0 00 -92000 6. [Multi-Year Financial Statement Projections) The Minoso Corporation anticipates a 20 per- cent increase in sales for 2020, 2021, and 2022. Minoso is currently operating at full capac- ity and thus expects to increase its investment in both current and fixed assets in order to support the increase in forecasted sales. The Minoso Corporation's 2019 income and bal- ance sheet statements are given in problem 4. A. Prepare an Excel spreadsheet model that projects the income statement, balance sheet, and statement of cash flows for 2020 prior to obtaining any additional financ- ing. Use a separate AFN long-term financing liability/equity) account to show the amount of financing needed to make the balance sheet balance. Extend your 2020 spreadsheet-based financial statement projections for two addi- tional years (2021 and 2022). What is the total amount of AFN needed over the three- year period? c. Show how your spreadsheet model projections will change if the AFN from Part B is financed by issuing additional long-term debt at a 10 percent interest rate . 20% Forecast 2020 20% Forecast 2021 20% Forecast 2022 2019 MINOSO CORPORATION Financial Statement Projections Nota: Projections are Prior to New Financing Decisions Ch 2, Probo Sales Growth Raat Income Statements Actual Percent 2010 Net Sales of Sales Forecast Basi 15000 100.0% Operating Expenses - 13000 88.7% Interest 409 1600 Taxes (40%) Net Income (N) 849 080 6.4% Cash Dividends (40% of NI) 184 Added Retailed Eamings 576 Balance Sheets Required Cash 1000 8.7% Surplus Cash Account Rec 2000 13.3% Inventories 14.7% Total Current Assets Fixed Assets, Net 840 Total Assets 12000 80.0% Accounts Pay 1000 10.7% Bank Loan 1800 Ace Lab 1200 8.0% Total Current List 4600 Additional Funds Needed (AFN) 0 Long-Term Debt Common Stock 2400 Retained Earrings 280 Totalflab & Equity 12000 "Bank loan (1800) - long-term debt (2200 times 10% interest rate 400 MINOSO CORPORATION Additional Funds Needed (AFN) Note: Financial Statement Projections are Prior to New Financing Decisions MINOSO CORPORATION Statement of Cash Flow Net Income Change in AR Change in Change in AP Change in Acc Lab CF from Operations Change in Fred Assets, Net CF from investments Change in Bank Loan Change in Long-Term Debt Change in Common Stock Payment of Cash Dividends CF from Financing Net Cash Flow Beginning Can Ending Cash Before Borrowing Taryel Ending Cash Kodtional Funds Needed (AFN) Cute AFN 2200 2020 0.0 2000.0 22000 - 16000 12000 1400.0 68000 6800,0 0.0 0.0 0.0 DO 0.0 8200.0 10000 12000 00 -9200.0 -92000 2021 0.0 0.0 0.0 0.0 00 00 00 0.0 0.0 0.0 00 00 00 0.0 0.0 0.0 0.0 0.0 -2000 2022 0.0 0.0 00 00 0.0 00 00 00 0.0 00 0.0 00 00 00 00 0.0 00 -92000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts