Question: Question 6 please This is what the question provides only 6. A firm has $1000 in cash available to invest. This is the only asset

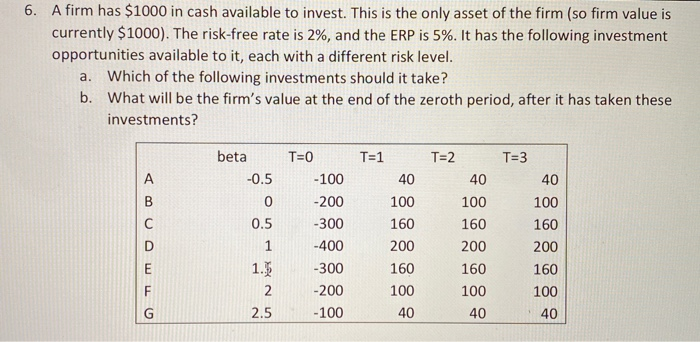

6. A firm has $1000 in cash available to invest. This is the only asset of the firm (so firm value is currently $1000). The risk-free rate is 2%, and the ERP is 5%. It has the following investment opportunities available to it, each with a different risk level. a. Which of the following investments should it take? b. What will be the firm's value at the end of the zeroth period, after it has taken these investments? T= O T=2 T=3 beta -0.5 0 0.5 40 100 160 OTO) T =1 -100E 40 -200 100 -300 1 60 -400 200 -300 -200 100 -100 40 40 100 160 200 160 160 2 100 2.5 40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts